Lede

Today we received the PCE inflation report and it came in at 2.5% YoY, in line with estimates and the lowest reading since February 2021.

PCE is, in fact, the measure that the Fed uses to target 2.0% inflation.

- PCE Price Inflation YoY:

- 2.5% vs 2.5% consensus and 2.6% prior.

- The lowest since February 2021.

- PCE Price Inflation MoM:

- 0.1% vs 0.1% consensus and 0% prior.

- Core PCE Price Inflation YoY:

- 2.6% vs 2.5% consensus and 2.6% prior.

- Core PCE Price Inflation MoM:

- 0.18% vs 0.1% consensus and 0.1% prior.

And further, we have this:

- Core PCE Excluding Housing YoY:

- • YoY: 2.1%

- Core PCE Market based prices YoY

- YoY: 2.4%

Story

Yesterday we received good news on the economy, with Q2 GDP growth from Q1 (YoY) coming in at 2.8%, well above estimates.

- US GDP Growth Rate:

- 2.8% vs 2% consensus and 1.4% prior.

But, this is an initial number and it will be revised several times.

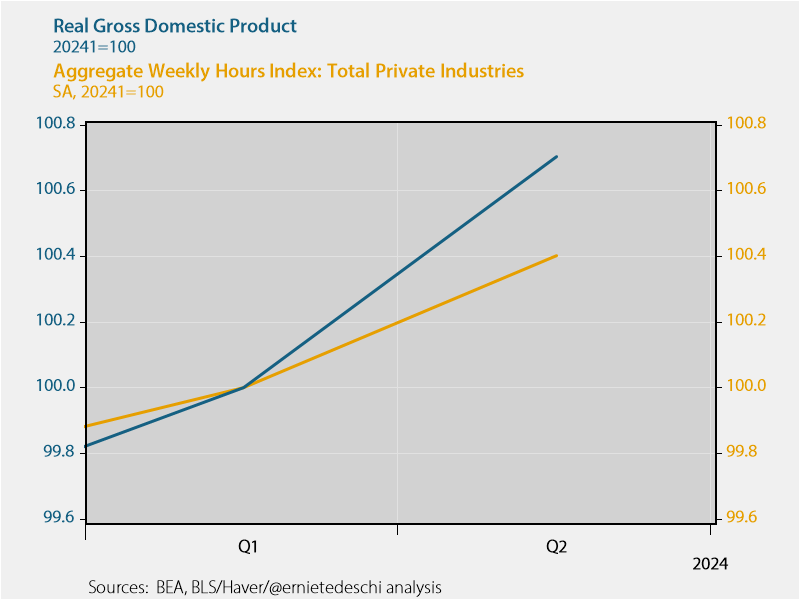

Ernie Tedeschi points out that GDP growth near 3% need not be inflationary. Strong output growth isn’t necessarily inflationary if driven by productivity gains. Q2 GDP growth outpaced aggregate private hours, indicating increased productivity.

This is how those words look in a chart from the same source:

That’s the good news.

What sure seemed like could be bad news was that Core PCE inflation for Q2 (the months April, May, and June) came in hot:

- US Core PCE Prices QoQ:

- 2.9% vs 2.7% consensus and 3.7% prior.

That meant, before today’s data, that one of two things was going to happen: either June (the data we just received) was going to be above estimates, or there were going to be revisions higher in the prior two months.

Now that we have the data, we see that the explanation was about as innocuous as we could have hoped.

The core PCE index increased by 0.18% in June, matching expectations and maintaining the 12-month rate at 2.6%.

The May figure was revised upward to +0.13% from +0.08%, which explains the larger-than-expected Q2 figure reported on Thursday.

- via @NickTimiraos

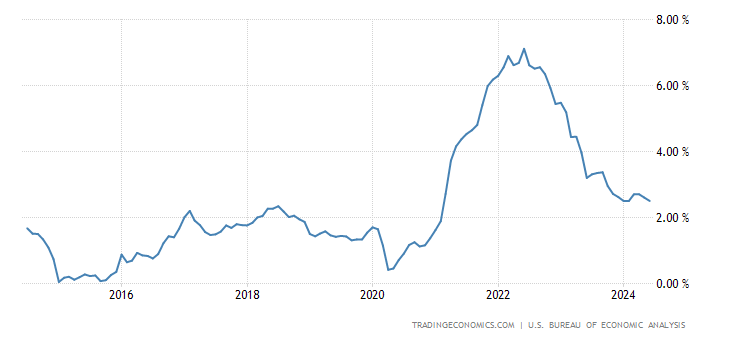

Here is a chart of PCE inflation YoY over the last 10-years:

PCE Price Inflation YoY 10-Year chart (Source)

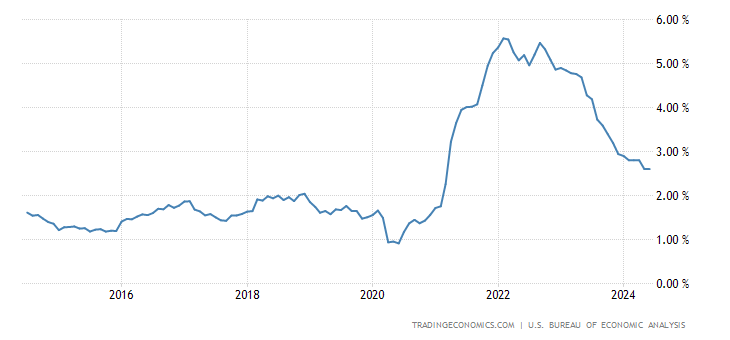

And here is a chart of Core PCE inflation YoY:

Core PCE Price Inflation YoY 10-Year chart (Source)

This all brings us back to the reality that the Federal Reserve has a dual mandate:

- Price stability (read: inflation)

- Maximum employment (read: labor market)

Well, I’ll make the same argument I have made for months now:

- Price stability (read: inflation)

- PCE inflation is at multi year lows and is within the normal bounds of acceptable

- Maximum employment (read: labor market)

- The unemployment rate is at multi-year highs

- Continuing jobless claims were at multi year highs before this Thursday’s weekly update

So, the price stability part of the mandate is moving in the right direction.

The maximum employment part of the mandate is moving, quickly in the wrong direction.

The Fed needs to cut rates, in my opinion, and should have done so months ago.

Alas, if it weren’t for the futures market, which places probabilities on rate movement from the Fed by meeting date, the Fed would cut in July.

Unfortunately, the Fed, foolishly, has let the futures market box it n.

The probability of a rate cut in July is now below 5%.

The probability of a rate cut in September is 100%, with an 87% probability of a single cut (0.25% cut) and a 13% probability of two cuts (0.50% cut).

There is no August FOMC meeting, so unless the Fed moves inter meeting, the US economy is going to have to hold on for two more months.

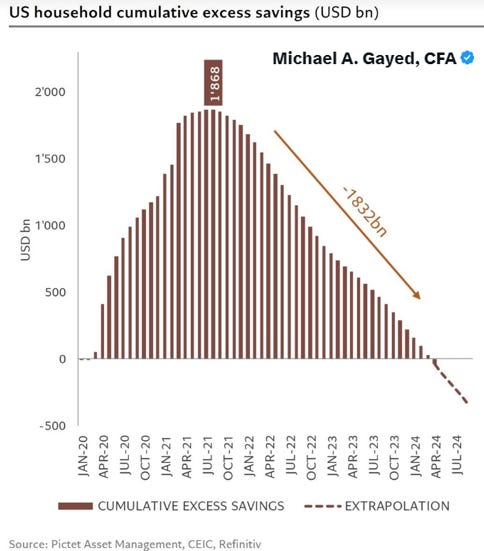

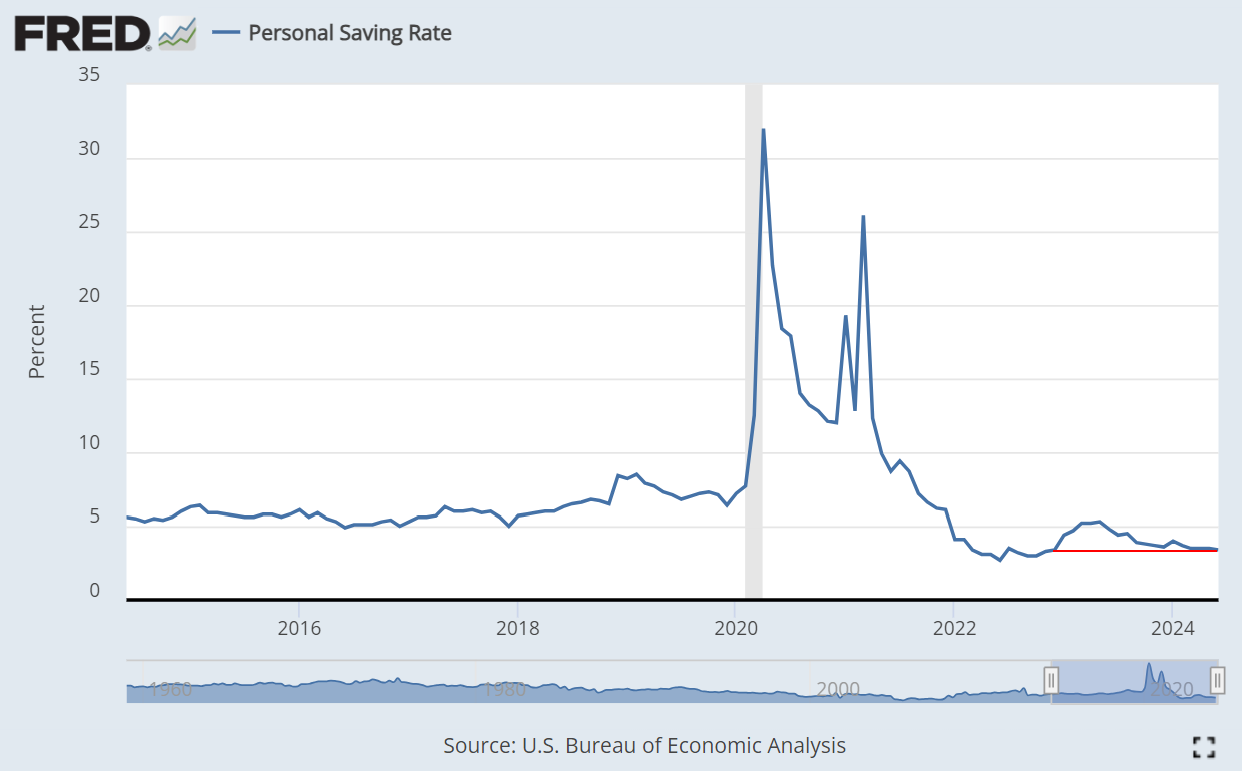

I note that credit card delinquencies are at decade highs (first chart below), and all of the excess savings from the fiscal policy during COVID are gone (second chart), while the savings rate (third chart) is now at a multi-year low:

Credit Card Delinquency Rate

Excess Savings

Savings Rate

So, we have inflation in real time at 2.4% (market based prices) with a target of 2.0% on the one hand, and the highest unemployment rate in several years on the other as credit card delinquencies are at decade highs and excess savings are gone.

Sure seems like cut sooner than later is the safest thing to do and it sure seems like the law (the mandate) demands it.

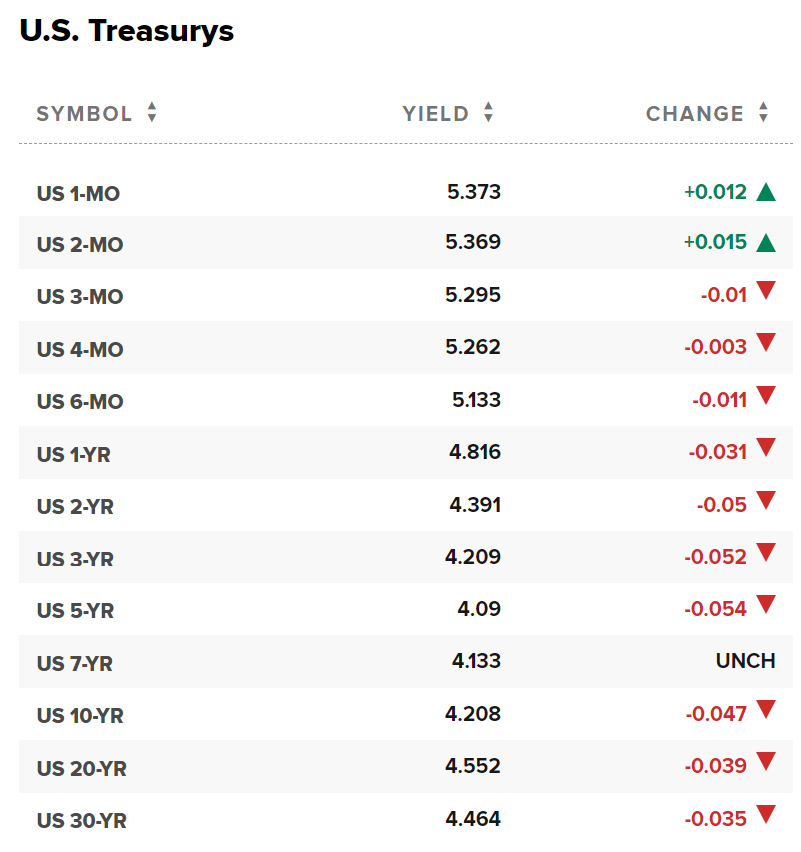

Treasury (interest) rates are down again:

And the 2/10 inversion is nearly gone:

What the Fed thinks about inflation and the underlying economic data is the only thing that matters.

I’ll repeat that: What the Fed thinks is the only thing that matters – the data has not mattered.

It’s time to cut rates.

If we don’t get a cut by September at the latest, here should be consideration of an impeachment of Chairman Powell.

Now is the perfect time to join CML Pro and prepare for the “After This” winners. Our exclusive stock picks have delivered a 272% return since 2016, far surpassing the NASDAQ, ARKK, and S&P 500.

We have 13 top picks, this email is about 1 of those. 600 institutions have them all.

You can too: Get CML Pro

Thanks for reading, friends.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.