Lede

Yesterday we wrote CPI Cools Faster than Estimates; Time to Cut Rates.

We echo that sentiment today with yet more data.

Today we received the Producer Price Index (PPI) which is also known as “Wholesaler Inflation,” as opposed to the Consumer Price Index (CPI) that we received yesterday, and much like CPI, PPI came in below estimates.

• PPI month over month (MoM) came in at -0.2% (as in negative).

• Core PPI came in 0.0% MoM. Both were well below estimates.

• On the flip side, weekly initial jobless claims came in above estimates.

First, the data, then the discussion:

- PPI YoY: 2.2% vs 2.5% consensus and 2.3% prior.

- PPI MoM: -0.2% vs 0.1% consensus and 0.5% prior.

- Core PPI YoY: 2.3% vs 2.4% consensus and 2.4% prior.

- Core PPI MoM: 0% vs 0.3% consensus and 0.5% prior.

- US Initial Jobless Claims: 242K vs 225K consensus and 229K prior.

- US Continuing Jobless Claims: 1820K vs 1800K consensus and 1790K prior.

Story

Yesterday, after the CPI report but before the Fed’s release of its Summary of Economic Projections (SEP), we wrote this:

- Disinflation has returned.

- Core CPI YoY is the lowest it has been since April 2021.

- Core CPI MoM is the lowest since August 2021.

- CPI MoM lowest since 2020.

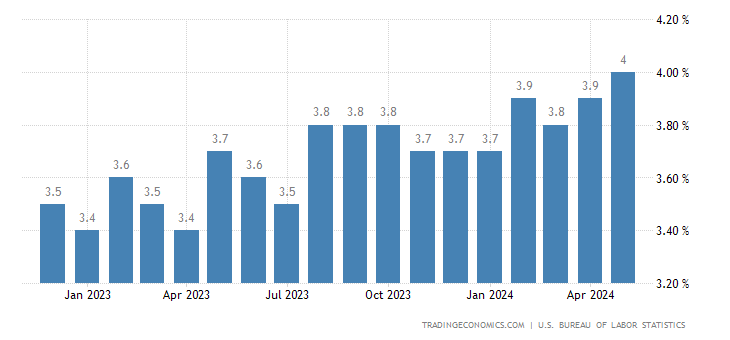

We also noted that the unemployment rate has slowly risen from 3.4% to 4.0%. And though we use the word slowly, it’s not that slowly:

For clarity, here is an 18-month chart of the unemployment rate, and no, it doesn’t look obviously steady without a reduction in monetary tightening.

US Unemployment Rate 18-Month chart (Source)

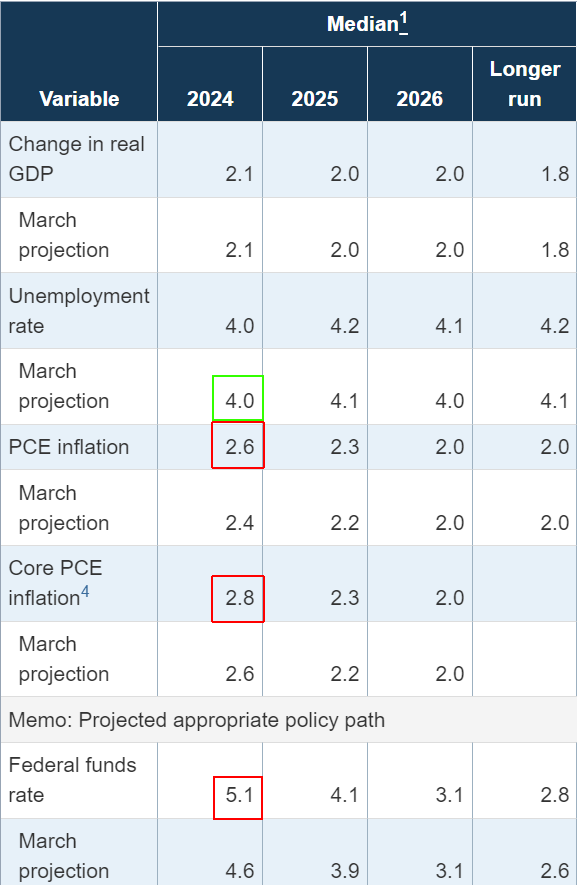

But, after our report yesterday the Fed released its SEP, sometimes referred to as “dot plots” because each member puts a dot on a chart for their projections of various economic data.

The abrupt conclusion was not just that the Fed went from a projection of three rate cuts in 2024 to now one. (In fairness, the prior SEP was straddling two and three cuts, so let’s say the projections went from 2.5 cuts to one cut.)

It was also that the Fed now sees inflation rising into the end of the year, yet sees the unemployment rate staying exactly where it is. Pardon me?

And, here is a full side by side of the Fed’s projections (SEP) just released yesterday compared to the same projections it made in March:

Note that PCE and Core PCE inflation projections are now higher than they were in March, that Core PCE projection of 2.8% is exactly where we are right now, that the ending Fed Funds rate implies one cut instead of three, yet magically the unemployment rate stays the same.

This more hawkish stance on inflation is centered on base effects, which refers to the fact that in the second half of 2023, there were many consecutive good (low) inflation prints, making a YoY comparison more difficult for the second half of 2024.

The PPI report we just received has various portions that feed into the PCE inflation report and it looks like Core PCE is going to drop to 2.7% when we get April data, while PCE will drop to 2.6%, the year end projection made by the Fed.

Just as the unemployment rate chart looked, let’s say, not steady.

Here is a 10-year chart of Core PCE (Source):

I’ll offer my analysis and opinion forthright, albeit a touch “really, you’re going there?”

With PPI MoM -0.2%, Core PPI 0.0% MoM, yesterday’s Core CPI YoY the lowest since April 2021, Core CPI MoM the lowest since August 2021, and headline CPI MoM the lowest since 2020…

… If we get another PCE, CPI, PPI report as we did in the last month, and the unemployment rate ticks up again, there should be consideration of an impeachment of Chairman Powell if the Fed does not cut rates in September and does not move its stance to considerably more dovish.

There are lots of “ifs” in there, but a monetary policy induced recession would be wholly unacceptable in that scenario; wholly unacceptable.

The problem with economic data is that trajectories stick: if the unemployment is on a rising trajectory it may not turn around quickly if the Fed does an “oops!”

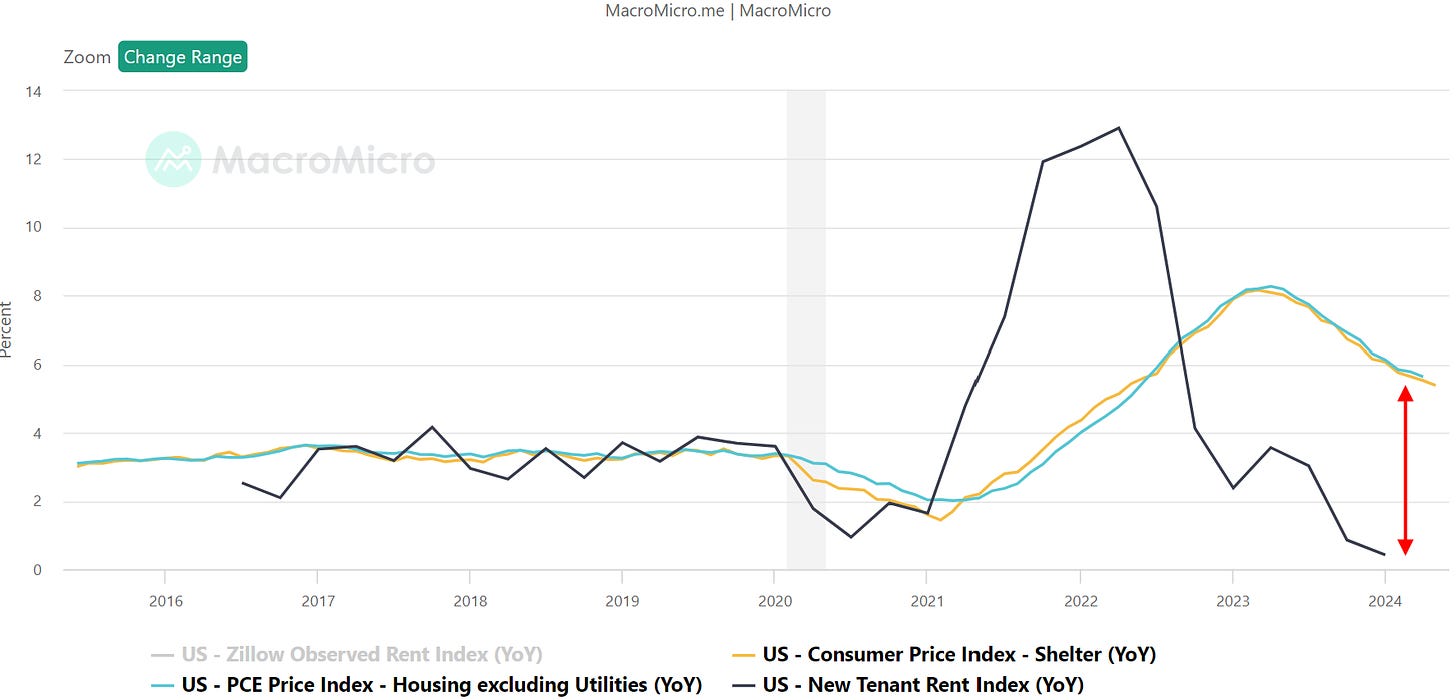

Inflation has been tamed, unemployment is rising, and the last bit of inflation even the Bureau of Labor Statistics (BLS), which is where all this data comes from, is signaling, “look, umm, that lagged cost of shelter number is totally wrong.”

Here is the newly introduced BLS measure of cost of shelter (rent) versus what the lagged measure that is driving 70% of inflation that we currently have:

That red gap is the lag (and a little bit of a measurement difference, but mostly lag), and without it CPI, Core CPI, PCE, and Core PCE are all at or below the Fed’s 2% target.

Enough already with this data. The Fed should not push the US economy into a recession with unemployment rising, and PCE inflation falling to 2.6%, even if there wasn’t an obvious data irritant.

But there is an obvious data irritant, it is essentially all of inflation above 2%, and the Fed needs to react appropriately before we see a recession. That’s my take.

Rates have dropped slightly today on the PPI news:

Conclusion

What the Fed thinks about inflation and the underlying economic data is the only thing that matters.

I’ll repeat that: What the Fed thinks is the only thing that matters – the data has not mattered.

Just yesterday we wrote the same words below and with the data on PPI, we write it again, perhaps with more vigor:

It’s time to cut rates, and waiting until September takes an unnecessary risk that we will turn to recession given that the unemployment rate has risen to 4.0% from 3.4%. Further, 43% of small businesses in the US were unable to fully pay their rent in April, the highest share since March 2021.

With PPI MoM -0.2%, Core PPI 0.0% MoM, yesterday’s Core CPI YoY the lowest since April 2021, Core CPI MoM the lowest since August 2021, and headline CPI MoM the lowest since 2020…

… If we get another PCE, CPI, PPI report as we did in the last month, and the unemployment rate ticks up again, there should be consideration of an impeachment of Chairman Powell if the Fed does not cut rates in September and does not move its stance to considerably more dovish.

There are lots of “ifs” in there, but a monetary policy induced recession would be wholly unacceptable in that scenario; wholly unacceptable.

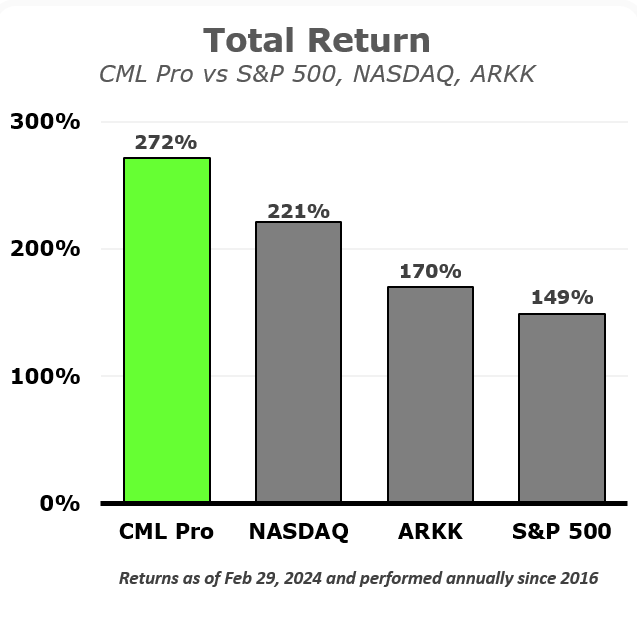

For a fuller discussion and to look into long-term stock research please learn more about CML Pro:

CML PRO IS PROUDLY UTILIZED BY 500+ OF THE WORLD’S LARGEST FINANCIAL INSTITUTIONS:

AND HAS DELIVERED SERIOUS RETURNS FOR SERIOUS INVESTORS:

Learn more here and watch a short but instructive video here.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.