Lede

Today we received the heavily followed CPI inflation report and the numbers were in line, if not below, estimates for the first time in several months. This is not the measure that is the Fed’s preferred measure, but it is the measure that gets the headlines. We also received the monthly retail sales number and it came in significantly below estimates.

Data Lede

- CPI YoY:

- 3.4% vs 3.4% consensus and 3.5% prior.

- CPI MoM:

- 0.3% vs 0.4% consensus and 0.4% prior.

- Core CPI YoY:

- 3.6% vs 3.6% consensus and 3.8% prior.

- Core CPI MoM:

- 0.3% vs 0.3% consensus and 0.4% prior.

- U.S. Retail Sales (MoM):

- 0.0% vs 0.4% consensus and 0.6% prior.

Story

Monthly CPI headline inflation and core inflation both fell to 0.3% for April from 0.4% in March.

Core CPI year over year (YoY) came in at its lowest since 2021.

US Core Inflation Rate (Core CPI YoY) 10-Year chart (Source)

Now, there are two critical points to be made before we do further analysis.

First, the Fed’s preferred measure for inflation is PCE not CPI:

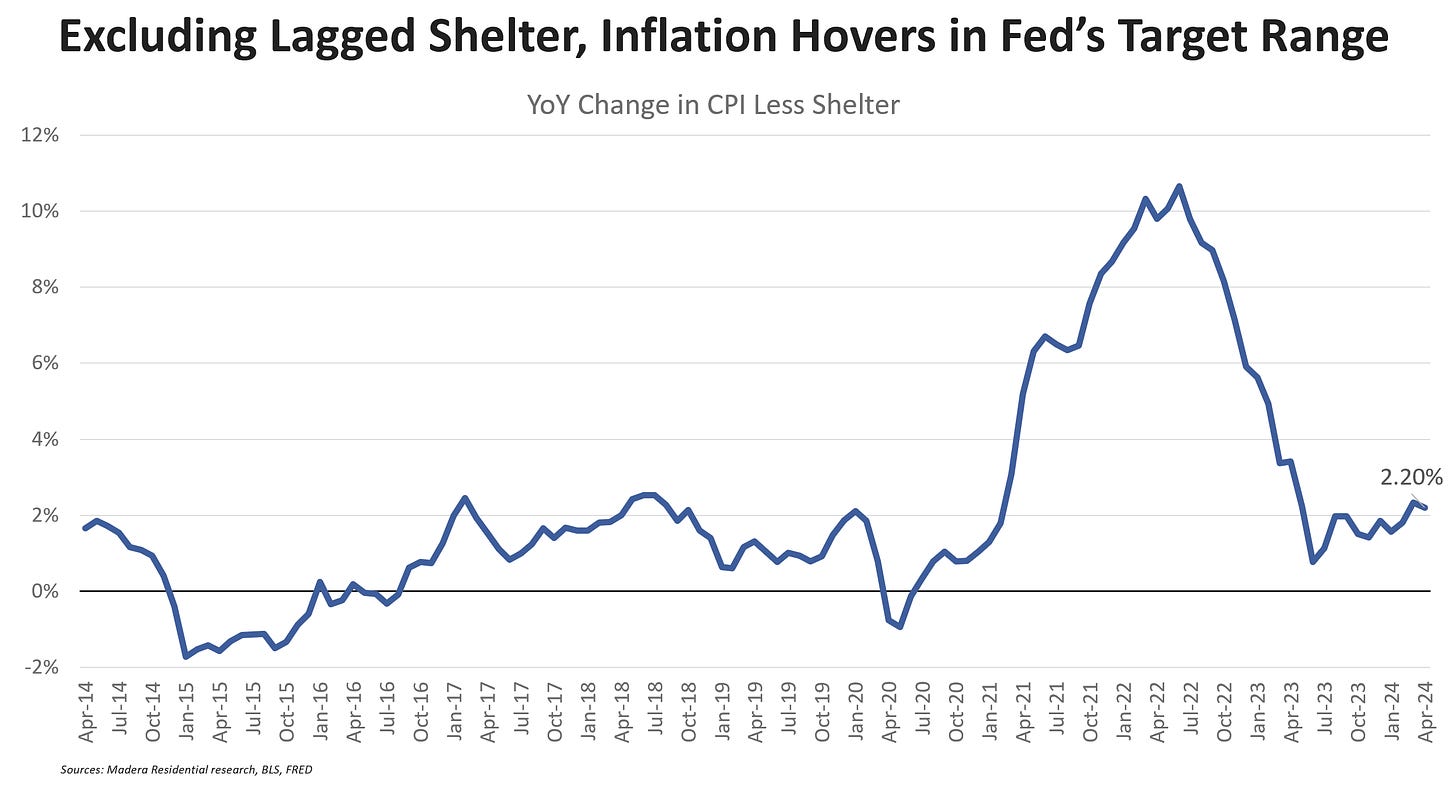

Second, yet again, CPI excluding shelter (excluding rent and OER) has been stable in the 2% range for a full year.

Here is an image from Jay Parsons:

The world economy and certainly the U.S. economy is being led by the nose by a lagged, broken measure of rent – specifically something called “owner’s equivalent rent” which is the hypothetical amount homeowners would pay to rent their own homes.

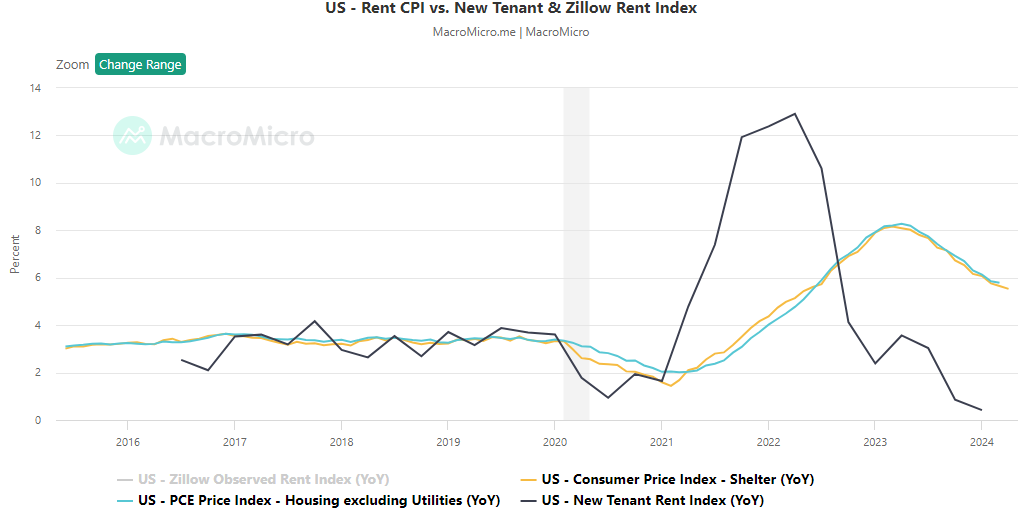

The Consumer Price Index (CPI) for rent increased by 5.44%, marking a two-year low and significantly lower than the peak of 8.11% reached in March 2023.

But, it’s still obtusely higher than the Fed’s new measure of the real time rent market for new tenants. Here is a chart:

Cost of shelter makes up 32% of CPI and 43% of Core CPI.

The shelter index accounted for over two thirds of the total 12-month increase in Core CPI and increased 5.5% in April, down from 5.7% in March.

Yes, Core CPI ex-shelter inflation would be 1%.

There is, however, good news here on the rent side and you can see it in that chart above – the year over year measure is colling, albeit slowly (the blue and yellow curves).

Further, shelter contributed 17.5 basis points to the monthly core CPI inflation in April.

While this remains high compared to the 2018-19 average of around 11 basis points, it is the lowest monthly contribution since December 2021.

CPI without rent would have been 0.1%.

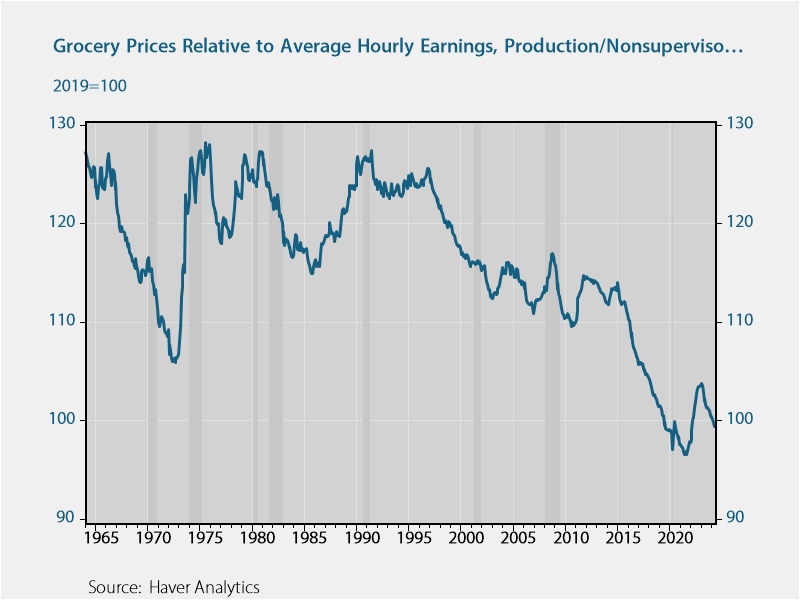

On the real wage side, wage growth is now significantly outpacing grocery inflation. When adjusted for wages, grocery prices have fallen below their 2019 levels.

Here is another chart from Ernie Tedeschi, the former chief economist at the Council of Economic Advisers for the Whitehouse:

In total, CPI measures of inflation came in at expectations and we saw our first cooling this year.

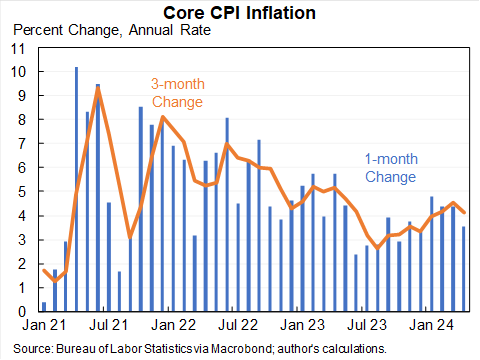

Here is a chart from Jason Furman:

Note that the yellow curve and blue bars went down for April – a first for 2024.

The retail sales number could be worrisome, or the star of what could be worrisome.

April retail sales were flat (0.0%), missing the estimated increase of 0.4% and down from the revised prior increase of 0.6% (previously 0.7%).

Sales excluding autos rose by 0.2%, matching estimates but lower than the revised prior increase of 0.9% (previously 1.1%).

The control group sales decreased by 0.3%, below the estimated increase of 0.1% and the revised prior increase of 1% (previously 1.1%).

We wrote before that while Fed Chairman Powell has leaned on strong economic data to allow the Fed time to decide what to do next, economic data is about trajectory, and once it starts moving on one direction it can be very difficult to change that trajectory.

Or, more colorfully, on Feb 2nd of this year we wrote, Jobs Very Strong; But F*** Around and Find Out.

In general, the inflation data was inline but finally stopped rising after three consecutive months.

Cost of shelter (rent) is falling, but painfully slowly.

Without lagged measures of shelter cost (rent), there would be no story for inflation – it would be at the Fed’s target and in fact has been for a full year now.

Yes, for a full year CPI has been at 2% excluding rent.

If the Fed maintains its restrictive monetary policy, the risk of a recession is real, and may be rising.

Treasury yields are down across the board this morning:

The probability of a rate cut in July has risen to 30%, and risen to 86% in September:

Conclusion

What the Fed thinks about inflation and the underlying economic data is the only thing that matters. The economy appears to be healthy but there are signs of consumer weakening.

So, let’s just wait and let the Fed lead us, for better or worse.

This is not the time for children and amateurs – this is not the time for catastrophizing. This is the time for patience and thoughtfulness.

Consider your long-term goals and your current perspective and, perhaps, consider what i means if they are in disagreement.

Take care of yourselves and your loved ones. The irritant was COVID and the further we get from the irritant the less irritated we will be.

The Fed needs to act sooner rather than later, in our opinion.

Thanks for reading, friends.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.