Preface

Today we received the Fed’s preferred inflation measure index, PCE and Core PCE and the numbers were “less bad” than they could have been given yesterday’s Q1 data dump.

We had a hint that there would be hotter than expected inflation today when we received the quarterly data for Core PCE yesterday.

However, the majority of the hotter than expected inflation in Q1 stemmed from the January revision. While March’s figures were stronger than expected, they were not excessively so.

On a month over month (MoM) basis both PCE and Core PCE came in at 0.3% as expected.

The YoY measures for both came in higher than estimates at 2.7% for PCE, versus 2.6% estimates and 2.8% for Core PCE versus 2.7% estimates.

This is certainly the “less bad” outcome given yesterday’s number for all of Q1 but…

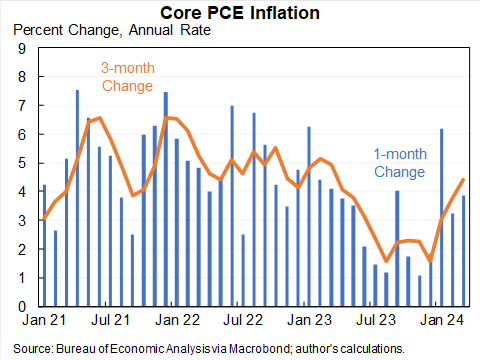

… No matter how we slice it, inflation in Q1 2024 has broken the down trend the market had grown accustomed to and priced in. Here is how Core PCE looks over various times frames from Jason Furman:

- 1 month: 3.9%

- 3 months: 4.4%

- 6 months: 3.0%

- 12 months: 2.8%

Here is a chart with the monthly and 3-month Core PCE changes:

The last three months are not the direction we want to see. The 3-month rate was 4.4%, up from 3.7% in February

The headline PCE measure looks similar.

Here is a 10-year chart of Core PCE (Source):

And here is a 10-yer chart of headline PCE (Source):

We also got a look at personal income and personal spending.

In March 2024, US personal income increased by 0.5% from the previous month, picking up pace from a 0.3% rise in February and matching market forecasts.

Personal spending in the United States rose by 0.8% in March, the same as in February and exceeding market forecasts of a 0.6% increase.

In total, the takeaway is that March’s PCE and Core PCE inflation numbers came out “less bad” than they could have been given the Q1 data yesterday, but the disinflationary trend from last year has paused, and may have even reversed.

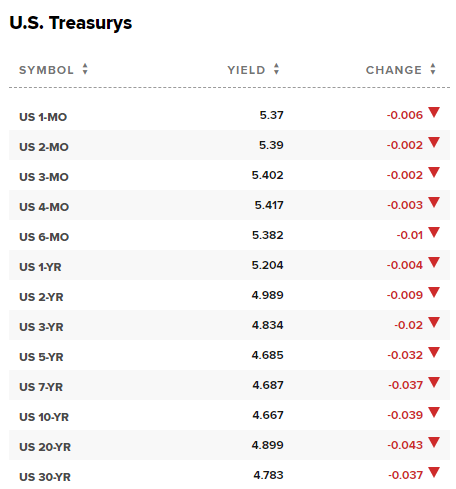

The treasury market actually rallied on this news, sending yields a bit lower, reflecting the “less bad” outcome:

The probability of a Sep rate cut remains at about 60%.

So, here we are. Q2 has begun and the inflation narrative has changed. If there is going to be a return to disinflation, at this point, it would catch the market off guard.

Having said that, catching the market off guard is pretty much par for the course in the last few years.

Here is the data from today:

Data Lede

- PCE Price Inflation YoY:

- 2.7% vs 2.6% consensus and 2.5% prior.

- PCE Price Inflation MoM:

- 0.3% vs 0.3% consensus and 0.3% prior.

- Core PCE Price Inflation YoY:

- 2.8% vs 2.7% consensus and 2.8% prior.

- Core PCE Price Inflation MoM:

- 0.3% vs 0.3% consensus and 0.3% prior.

- US Personal Income MoM:

- 0.5% vs 0.5% consensus and 0.3% prior.

- US Personal Spending MoM:

- 0.8% vs 0.6% consensus and 0.8% prior.