4-25-2024

Preface

The economic news we received today, at first blush, came in weak on the growth side (GDP) and hot on the inflation side – an insidious elixir that would lead to stagflation if it persisted.

Stagflation is an economic condition characterized by slow economic growth, high unemployment, and rising prices.

A closer look at the data does show slightly hotter inflation, but private domestic growth, in fact, looks quite robust. This isn’t stagflation.

First the data, then the discussion:

Data Lede

- US Initial Jobless Claims:

- 207K vs 214K consensus and 212K prior.

- US Continuing Jobless Claims:

- 1781K vs 1814K consensus and 1796K prior.

- US Jobless Claims 4-week Average:

- 213.25K and 214.5K prior.

- US GDP Growth Rate:

- 1.6% vs 2.5% consensus and 3.4% prior.

- US PCE Prices QoQ:

- 3.4% and 1.8% prior.

- US Core PCE Prices QoQ:

- 3.7% vs 3.4% consensus and 2% prior.

- US Wholesale Inventories MoM:

- -0.4% vs 0.2% consensus and 0.4% prior.

Story

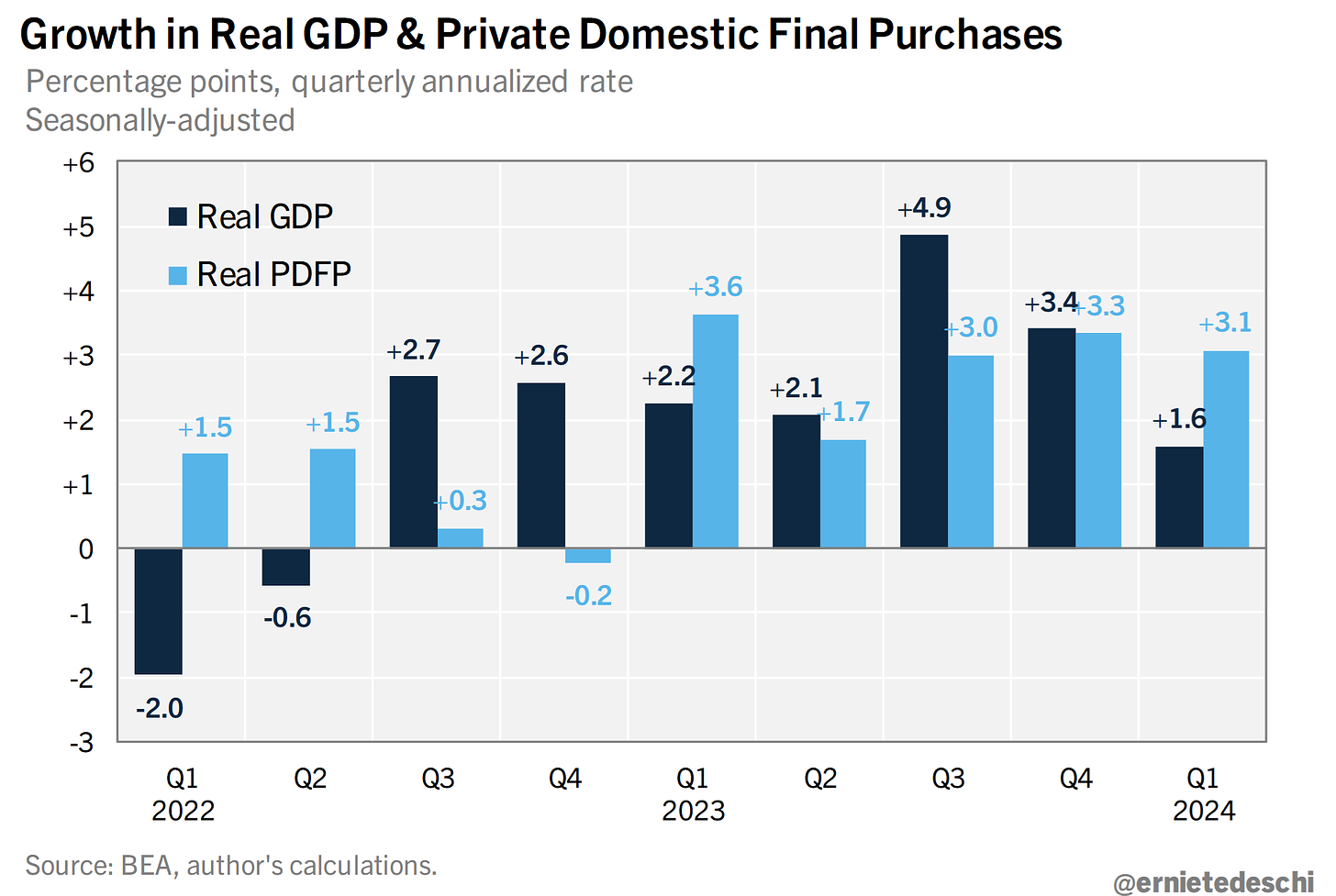

Real GDP growth came in at 1.6% in Q1, softer than expected. But that appears to be driven by weakness in volatile components, especially net exports. Private domestic final purchases–“core GDP” made up of consumption & fixed investment–grew 3.1%, a very strong print.

We can follow that Private Domestic Financial Purchases number here in a chart from Ernie Tedeschi, the Former Chief Economist at The White House Council of Economic Advisers (CEA). Note the light blue bar – it’s quite strong:

The takeaways from the data are the following:

- Final sales to domestic purchasers (excluding inventories and trade): increased by 2.8%.

- Final sales to domestic private purchasers (excluding government, inventories, and trade): advanced by 3.1%.

- Real final sales: increased by 2%.

- Consumption: Exceeded expectations.

- Business investment: Fell below expectations, typical with substantial fiscal support countered by high interest rates.

- Implication: Private sector activity remains robust, despite overall growth slowing.

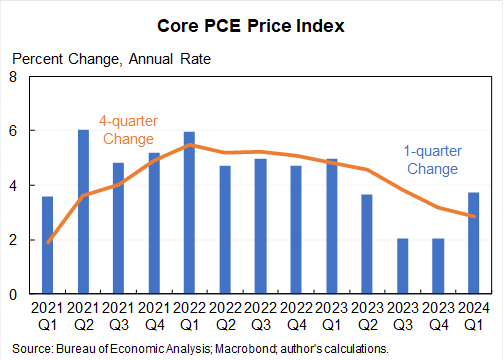

That deals with the growth side. But the inflation side is not as easily explained other than.. “it’s higher.”

Core PCE rose at an annual rate of 3.7% during Q1 2024, up from 2.9% from Q1 2023 and well above estimates of 3.4%.

The final PCE (and Core PCE) price index numbers for Q1 will be out tomorrow with March’s numbers.

Here is a chart from Jason Furman (Professor of Practice at Harvard; Senior Fellow Peterson Institute and former Chair of President Obama’s CEA.

That blue bar is not the direction we wanted to see:

We will see how March PCE numbers come out tomorrow; likely hot.

So, on the one hand, the economy remains robust and a stagnant economy does not appear in the cars – at least not yet. On the pother hand, inflation appears to have remained sticky and, for now, stopped its clear march lower.

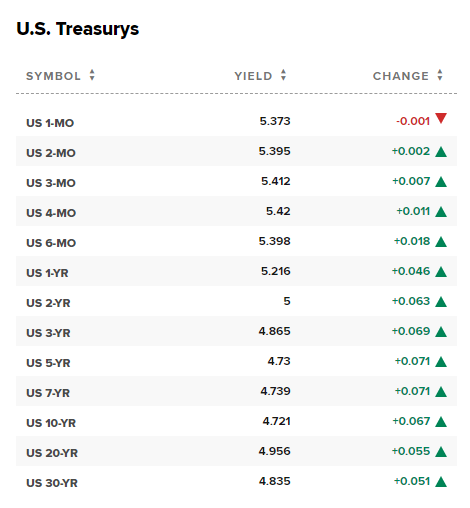

Treasury yields are up across the board:

The futures market is still pricing a first rate cut in September, but the probability is at about 58%.

That’s it for today.

We don’t see stagflation, but do see stickier inflation, for now.

Conclusion

The Fed doesn’t need weak economic data to cut rates – the Fed needs inflation to drop to cut rates.

We have seen consistently slower wage inflation but as we have said many times: the crucial factor is PCE and Core PCE inflation.

The Fed targets those two measures.

Last time we spoke about PCE and Core PCE we wrote that “those numbers look good, with PCE inflation at 2.5% and Core PCE inflation down to 2.8%.”

Well, we’re about to find out if that reverses.

What the Fed thinks about inflation is the only thing that matters… as long as the economy stays strong. We do have a strong economy, irrespective of the crazed headlines today… for now.

That’s a win… for now.

Rates are just conversation if the economy stays strong and inflation stays tame. After this may be here, but then again…

… What the Fed thinks about inflation is the only thing that matters… as long as the economy stays strong.

Have a fabulous week.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.