Hot Take

Amid the persistent inflation fears and the hysteria often amplified on social media, I remain cautiously optimistic.

While I don’t claim to know the future, my stance—that inflation is cooling and the labor market remains resilient—is supported by data and reviews I’ve written over the past year. I’ll lay out my reasoning in the discussion ahead along with fresh data.

Lede

In the last two weeks we received good economic data with respect payrolls, wage inflation, wholesale inflation, and now consumer inflation.

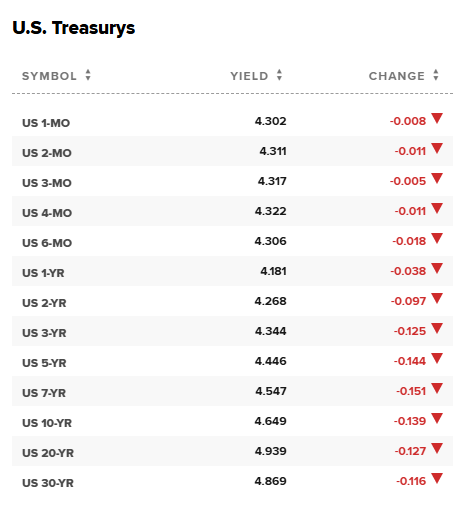

Both the stock and bond markets are rallying today on CPI news and, likely, the totality of the news in the last five days.

With bonds rallying so yields are dropping:

Preface

Here is some data, and then we move to a review:

Jobs

- Non farm payrolls (1-10-2025):

- 256K vs 160K consensus and 212K prior.

- The most in nine months.

- Private non farm payrolls:

- 223K vs 135K consensus and 182K prior.

- The most in nine months.

Inflation

- Average Hourly Earnings YoY:

- 3.9% vs 4% consensus and 4% prior.

- US Average Hourly Earnings MoM:

- 0.3% vs 0.3% consensus and 0.4% prior.

- Producer Inflation (PPI YoY):

- 3.3% vs 3.4% consensus and 3% prior.

- Producer Inflation (PPI MoM):

- 0.2% vs 0.3% consensus and 0.4% prior.

- Producer Core Inflation (PPI YoY):

- 3.5% vs 3.8% consensus and 3.5% prior.

- Producer Core Inflation (PPI MoM):

- 0% vs 0.3% consensus and 0.2% prior.

- CPI YoY:

- 2.9% vs 2.9% consensus and 2.7% prior.

- CPI MoM:

- 0.4% vs 0.3% consensus and 0.3% prior.

- Core CPI YoY:

- 3.2% vs 3.3% consensus and 3.3% prior.

- Core CPI MoM:

- 0.2% vs 0.2% consensus and 0.3% prior.

Sentiment

- US NFIB Business Optimism Index:

- 105.1 vs 100.8 consensus and 101.7 prior.

- The highest since October 2018.

Discussion

The “inflation is coming back” narrative took hold over the last several weeks, pushing bond yields higher and equity prices lower.

In the last two days we see a partial reversal of that sentiment as PPI and CPI came in “pretty good” and “not so bad,” respectively.

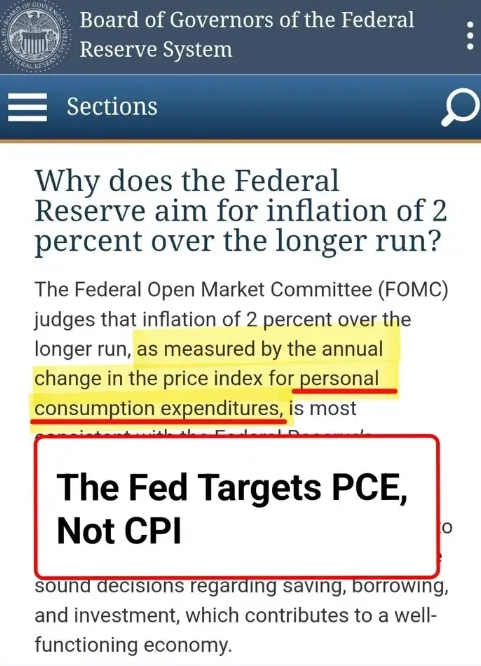

Ultimately the Fed’s 2% target is for neither of those two inflation measures, but is rather for PCE (personal consumption expenditures) inflation.

Here is a screenshot from the Fed Board of Governors site clearly stating both the 2% target and the index attached to it:

The PCE inflation index is at 2.4% YoY (year-over-year) and Core PCE (that’s PCE but excluding food and energy) is at 2.8%.

I presented a fuller discussion in the last CML Pro webinar which points to my “forecast” that PCE (the inflation that the Fed targets) will hit 2.1% or lower by April.

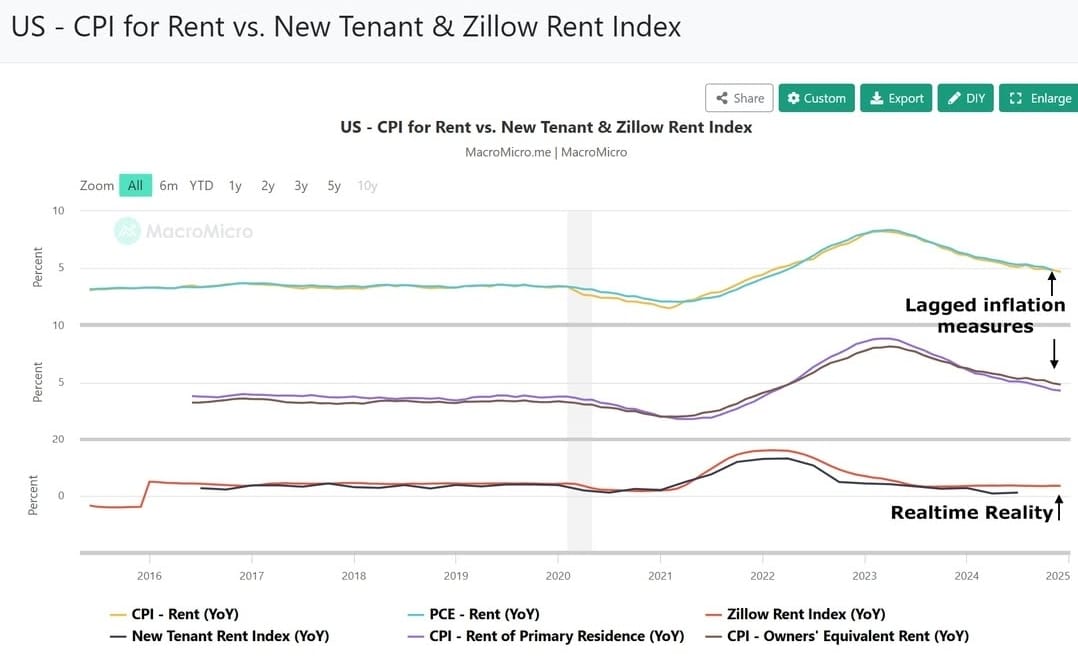

As for the items driving inflation, or let’s stay, keeping it “sticky,” we still have same offenders – two dreadfully lagged measures of rent (in total called “shelter inflation”).

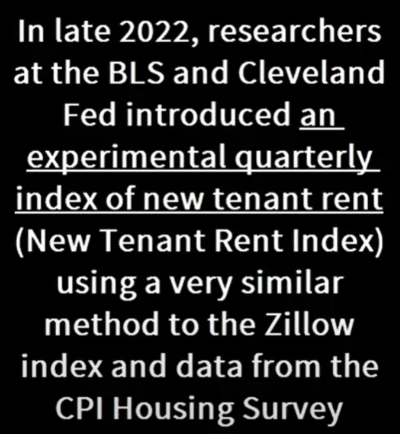

This lag has been so bad and so impactful on inflation that in late 2022, the Bureau of Labor Statistics (BLS), the very body that computes inflation, introduced a new real-time measure of shelter inflation (rent) called the New Tenant Repeat Rent Index.

Yep in late 2022, researchers at the BLS and the Cleveland Fed introduced an experimental quarterly index of new tenant rent.

This index uses real-time data (rather than lagged data) to track rent changes more accurately for new tenants, addressing the lag in traditional measures of shelter inflation. It provides a more up-to-date reflection of rental market conditions.

If we look at that measure, again, computed directly by BLS, compared to the numbers in CPI and PCE, we see this chart:

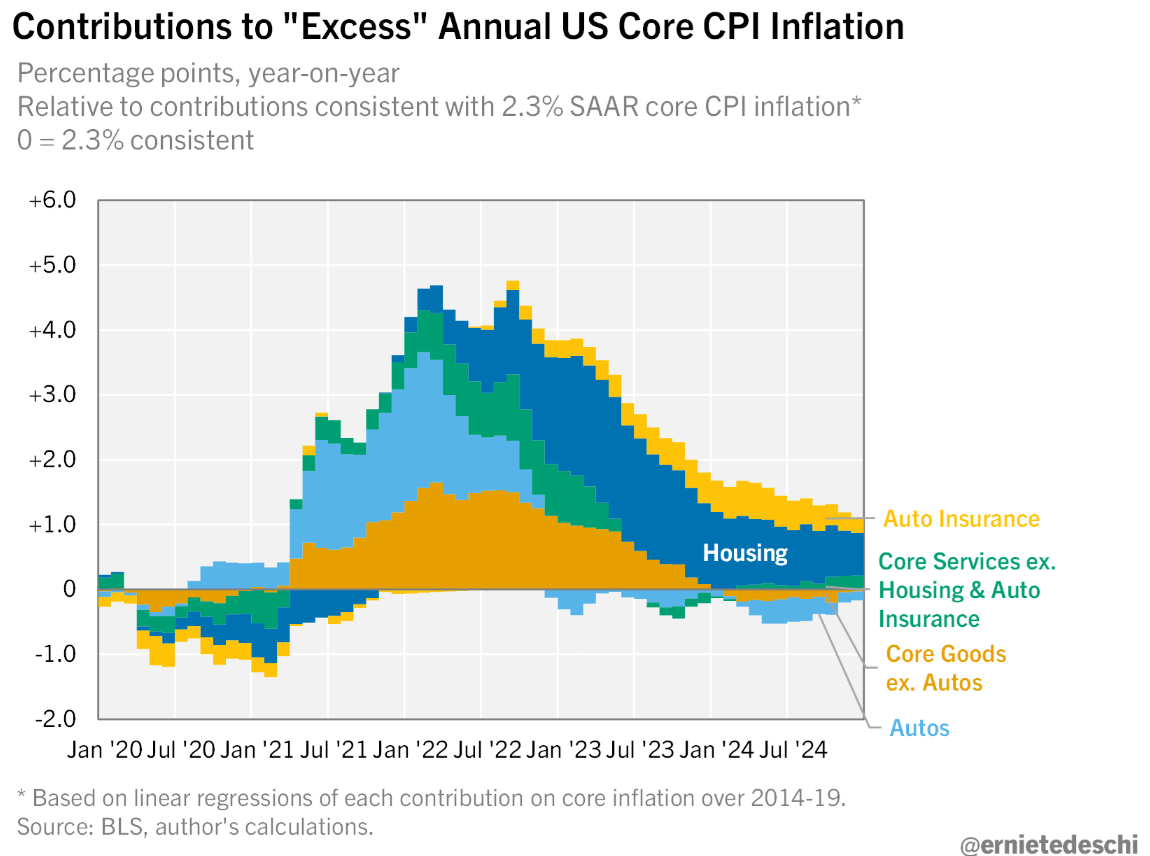

And how much of inflation is driven by the lagged measure of rent? Kind of all of it. Here is a chart:

We see housing, which is this lagged measure, and auto insurance.

Auto insurance makes sense given the inflation we saw in new and used cars from the COVID era. As prices rose so too did the cost to insure them (obviously). I see no reason for that inflation to continue, which is to say, I see no reason for it to continue rise on top of its current levels in the future. If anything, used car prices are dropping:

1152025.png)

So, in total, I continue to see inflation as solved. Whether we hit 2% and stay there “forever,” is unknown and maybe more importantly not the point. The point is that we don’t (yet) have a reinflation problem and data suggests we will see yet more cooling in PCE quite soon due to base effects (see the recent CML Pro webinar for details).

The focus for me, and I think should be for the rest of the world, is the US labor market.

As long as jobs stay strong and wage inflation stays tame, we should see a strong US economy, strong earnings growth, and therefore a pretty good stock market.

I’m focused on the ten pillars of generative AI and the earthquake that will, at some point, come to software and possibly the world economy. But, for 2025, I feel good.

The shakedown / negative disruption of generative AI will likely play out n the tail end of 2025 and more fully in 2026.

That’s it for now as we prepare for earnings season.

Conclusion

In conclusion, the recent economic data paints a promising picture, with cooling inflation, a robust labor market, and improving sentiment.

While challenges remain—particularly with lagged measures of rent affecting inflation—the overall trajectory suggests continued economic strength and potential for further stabilization.

The Fed, though initially slow to adjust rates, took an important step with a 0.50% rate cut at the September 2024 FOMC meeting, contributing to a total reduction of 100 basis points (1%) as of today. This decisive action is beginning to have an impact—or may already be doing so. At this stage, there appears to be no urgent need for further rate cuts.

As we enter earnings season, attention should remain focused on the interplay between employment trends and inflation, as both are critical to sustaining growth.

Finally, the evolving landscape of generative AI presents both opportunities and disruptions that could reshape the economy in the coming years. For now, however, 2025 appears well-positioned for resilience and progress.

As for the persistent inflation fears and the hysteria often amplified on social media, I’m over it. This is my perspective on inflation, and time will tell if I’m correct. In short, I see no reason for panic and far better reason for optimism.

2025 is the year: pivotal and driven by realized generative AI gains.

We are “After this” with respect to COVID and inflation Now is the time to access deep research, CEO interviews, and our Top Picks.

Thanks for reading, friends.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.