Preface

(Reminder: Yesterday I penned Jobless Claims Fresh Highs; Manufacturing Fresh Lows.)

As of today, we will have a Fed that is on the right side of the market as opposed to in opposition to it. That’s the silver lining. The Fed will cut.

Today we received the non farm payrolls (NFP) report and saw what many, including myself, have long feared.

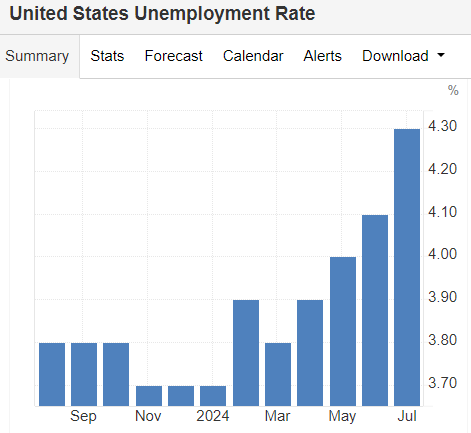

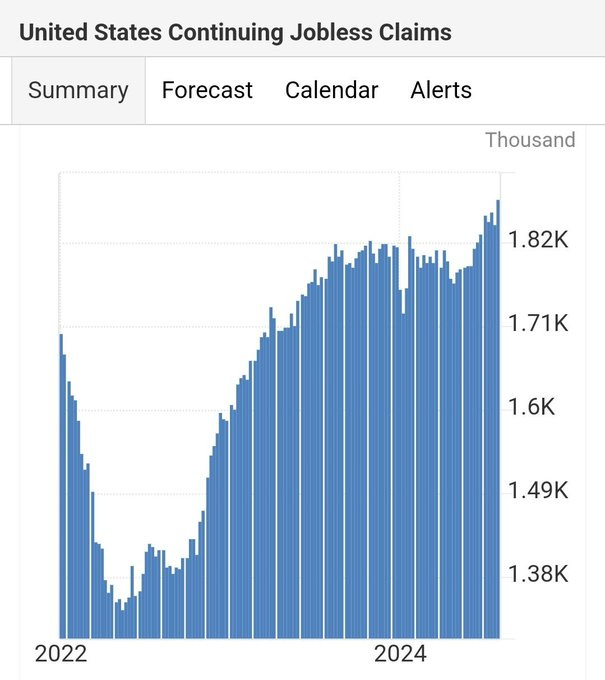

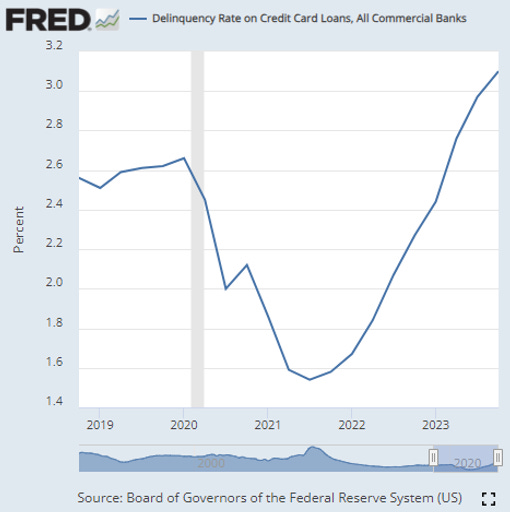

Even with the unemployment, before today, at multi year highs, continuing jobless claims at multi year highs, credit card delinquencies at multi year highs, manufacturing employment PMI at multi-year lows, wage inflation at multi-year lows, and inflation at multi year lows, even then, the Fed did not cut rates two days ago (or several months ago).

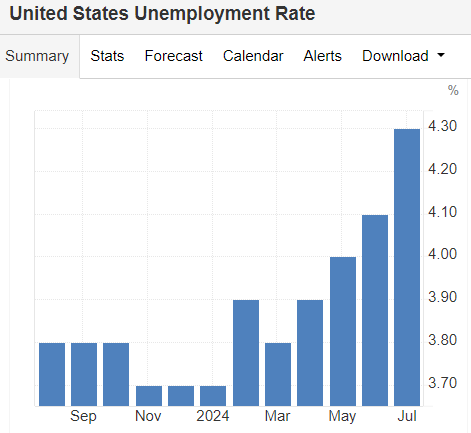

Today we got worse news: the unemployment rose to 4.3% from 4.1%, and while participation rose 0.1%, still, the 0.2% rise points to old fashioned higher unemployment.

As Nick Timiraos noted:

At [the Fed’s] June meeting, the unemployment rate in front of Fed officials was 4.0%.

Only 3 of 19 projected an unemployment rate ending Q4 [2024] above 4.1% under their base case outlook (which assumed 1-2 cuts this year).

None had it above 4.3% in 2025-26.

The Fed’s forecasts are wrong, it was late cutting rates and the unemployment rate is on a bad trajectory.

Here is the chart of unemployment:

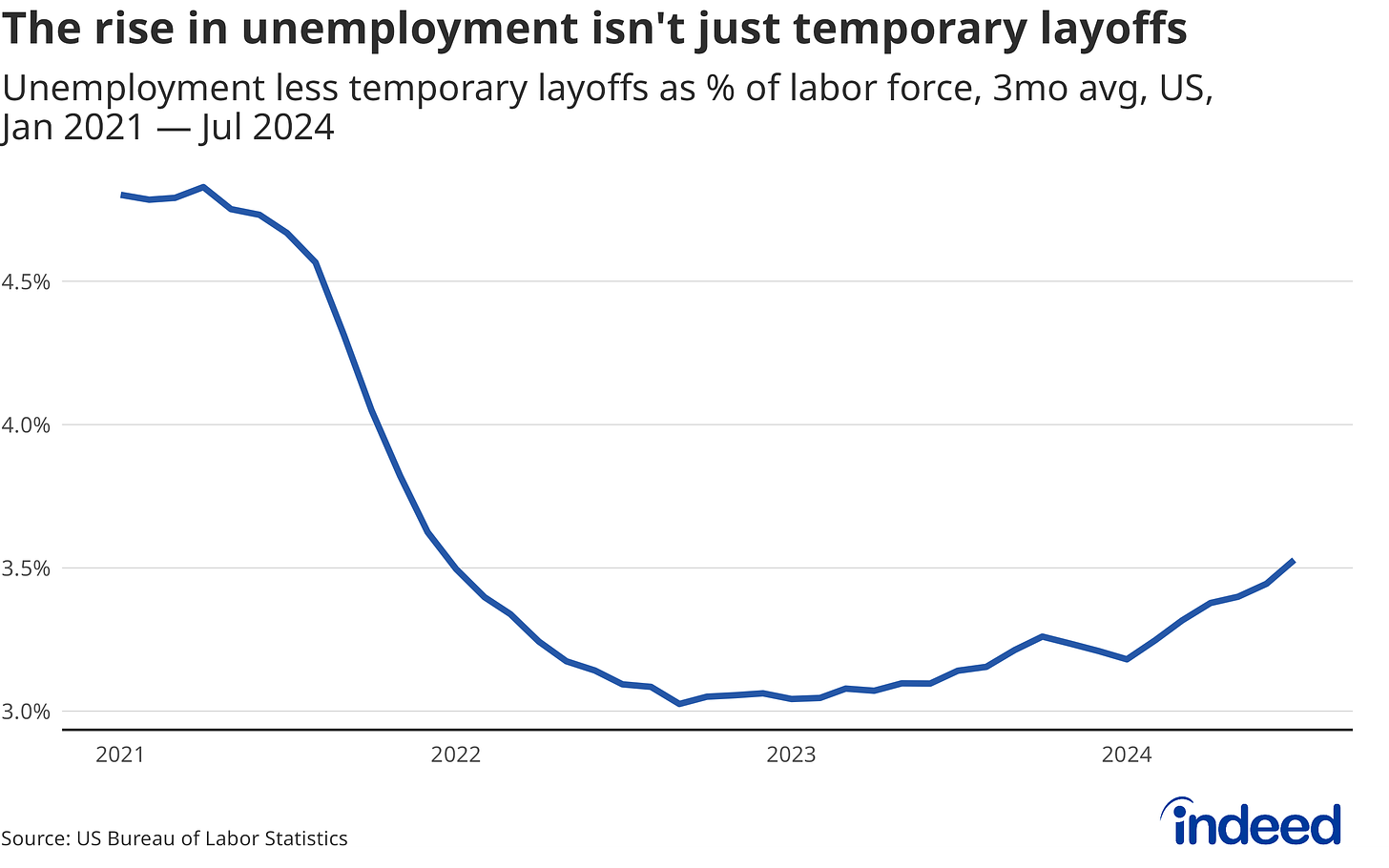

And, the rise in unemployment is NOT due to just temporary layoffs, so “the hurricane reduced employment” isn’t a full explanation.

Here is a chart from Nick Bunker.

Here is the rest of the data before some short analysis.

- US Non Farm Payrolls:

- 114K vs 175K consensus and 179K prior.

- US Average Hourly Earnings YoY:

- 3.6% vs 3.7% consensus and 3.8% prior.

- US Average Hourly Earnings MoM:

- 0.2% vs 0.3% consensus and 0.3% prior.

- US Average Weekly Hours:

- 34.2 vs 34.3 consensus and 34.3 prior.

- US Unemployment Rate:

- 4.3% vs 4.1% consensus and 4.1% prior.

- US Labor Force Participation Rate:

- 62.7% and 62.6% prior.

Story

At this point, I am simply repeating myself from several months ago.

What the Fed thinks about inflation and the economy are the only things that matter.

The data in and of itself doesn’t matter to the Fed and unfortunately we learned that several months ago.

So, what is there left to say?

At a snapshot, as if there were no trends, a 4.3% unemployment rate and +114,000 jobs in July is quite reasonable.

But trends do matter, and as I have said, once economic data takes on a trajectory it rarely (if ever) stops where we want it to.

I expect (or I hope) there will be a rate cut intra-meeting, perhaps at Jackson Hole in late August.

Here are the crucial charts and for all the “data dependent” talk from the Fed, they are not data dependent, they are narrative dependent, and nobody really knows what narrative they are following.

Here is the chart of unemployment (multi-year high):

Here is Continuing Jobless Claims (multi-year high)

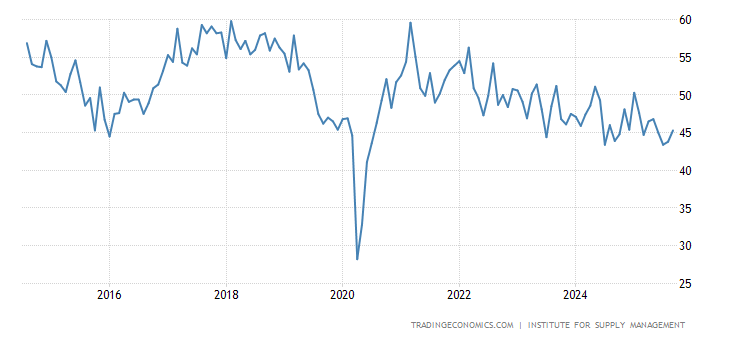

Here is a chart of ISM Manufacturing Employment (Source) (multi-year low)

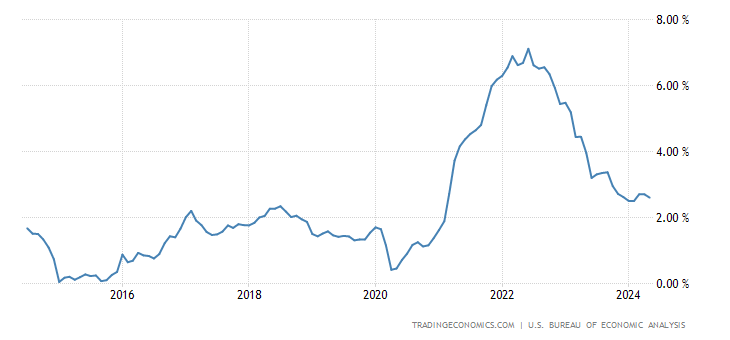

Here is the chart of PCE inflation (the one the Fed targets) (Source) (multi-year low):

Credit Card Delinquencies (multi-year high):

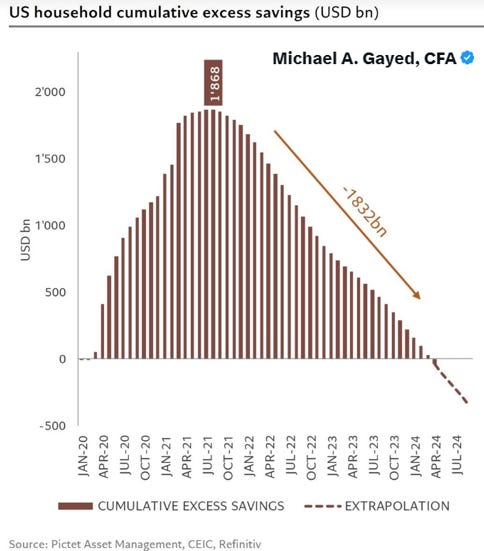

US Household cumulative excess savings (multi-year low):

Real Disposable Personal Income (YoY):

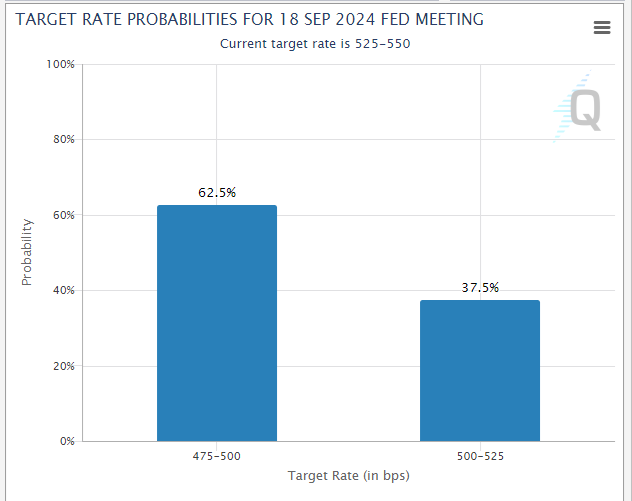

The odds of a “double” (50 basis point) rate cut in September have risen to 62.5%, from 11.8% two days ago and the overall odds of a rate cut (one or two) are at 100%.

Treasury yields are falling as investors pile into safe haven assets in a hedge against or preparation for a recession.

I still believe in the US consumer but the odds of a recession are rising.

Conclusion

The Fed was late to raise rates and is now late to cut rates.

I said so. Many others did too. But it doesn’t matter.

What the Fed thinks about inflation and the economy are the only things that matter.

The odds of a recession have risen.

The economy and stock market are now just derivatives of the actions taken (or not taken) by an inept Federal Reserve.

Recession is 50% reality and 50% perception.

If the Fed moves immediately we could save the perception half of a recession.

With strong Q2 GDP and at least positive job growth (i.e. positive payrolls), perhaps we escape a recession with a quick rate cut.

At a snapshot, as if there were no trends, a 4.3% unemployment rate and +114,000 jobs in July is quite reasonable.

But trends do matter, and as I have said, once economic data takes on a trajectory it rarely (if ever) stops where we want it to.

Thanks for reading, friends.

Now is the time to join CML Pro, if you would like to receive more economic updates like this and have access to our Top Picks. Over 600 institutions use our research, you can too.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.