Today we received retail sales data for the month of May and the number came in at 0.1% versus estimates of 0.2% and -0.2% in the prior month.

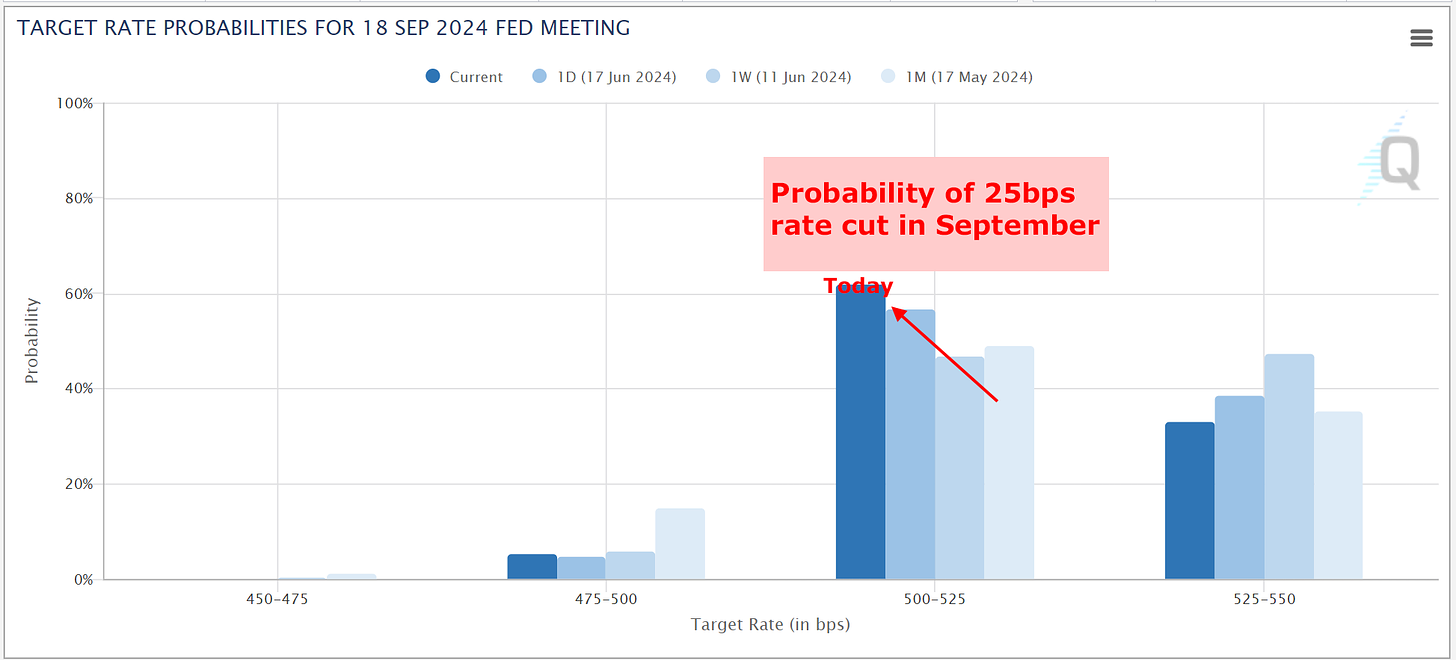

The probability of a 25bps (0.25%) rate cut in Sep FOMC meeting has risen on weaker than expected retail sales, lower CPI, Core CPI, PPI, Core PPI, and rising unemployment rate.

i.e. lower inflation, slightly weakening consumer, weakening job market.

Here is a chart of the probabilities for the September 2024 Federal Open Market Committee (FOMC) meeting:

Here is a reminder of the latest CPI, PPI, and the unemployment data:

- PPI MoM -0.2%.

- Core PPI 0.0% MoM.

- Core CPI YoY the lowest since April 2021.

- Core CPI MoM the lowest since August 2021.

- Headline CPI MoM the lowest since 2020.

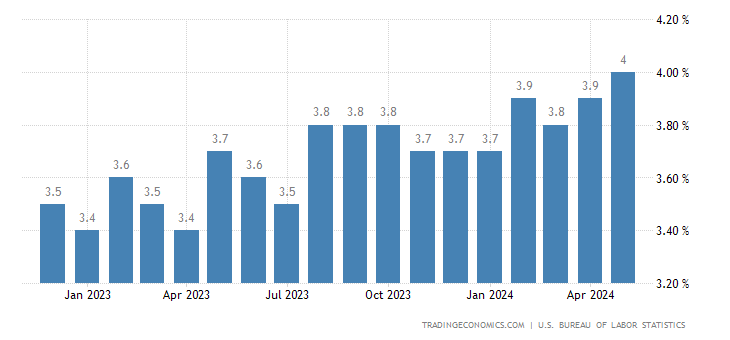

- Unemployment rate is up to 4.0% from 3.4%.

US Unemployment Rate 18-Month chart (Source)

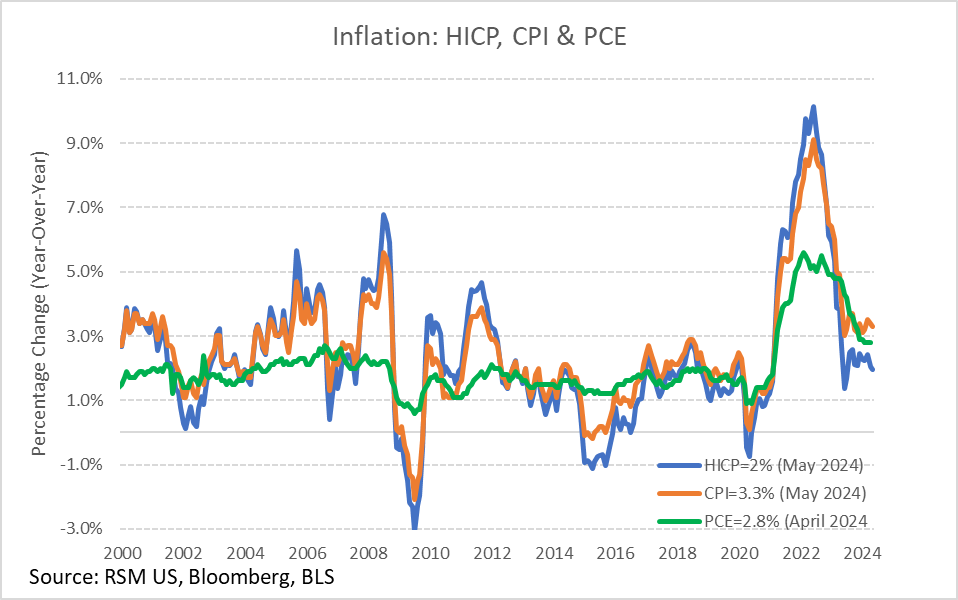

Here is a 10-year chart of Core PCE (Source):

The comparison of the U.S. Harmonized Index of Consumer Prices (HICP) and the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) suggests that if inflation were calculated similarly to the United States’ main trading partners, the Federal Reserve might be considering a rate cut.

Specifically, U.S. HICP stands at 1.95%. Here is a chart from Joseph Brusuelas (RSM US LLP Principal & Chief Economist. Named 2023 best rate forecaster by Bloomberg.)

We’re already below 2% inflation.

It is wholly inappropriate to have a monetary policy induced recession at this point.

Thanks for reading.

Act Now Before It’s Too Late!

Retail investors, the window of opportunity to access CML Pro may be closing soon. Don’t miss out on the chance to join the ranks of elite investors benefiting from our exclusive research, expert stock picks, and in-depth market analysis.

Secure your subscription to CML Pro now, before it becomes available only to professional investors. Click here to get started: https://bitly.com/CMLPro.

Be Proactive with Your Investments! Join the savvy investors who are preparing for the “After This” period with CML Pro. Don’t wait—your path to smarter investments starts today!

For a fuller discussion and to look into long-term stock research please learn more about CML Pro:

CML PRO IS PROUDLY UTILIZED BY 500+ OF THE WORLD’S LARGEST FINANCIAL INSTITUTIONS:

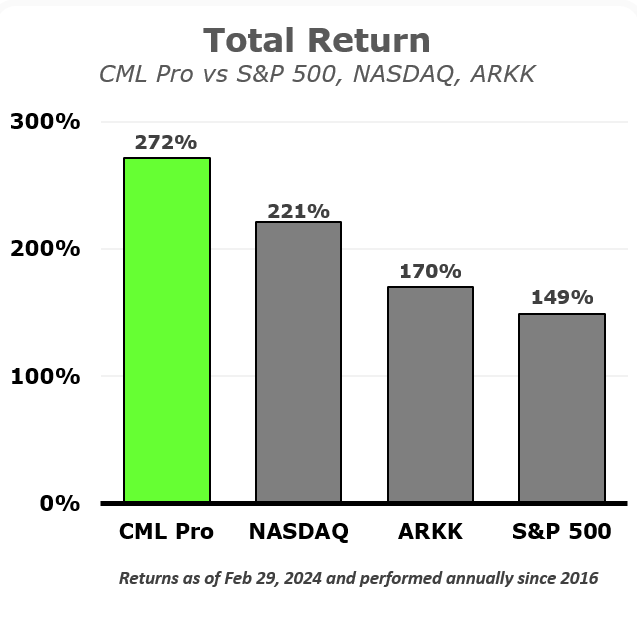

AND HAS DELIVERED SERIOUS RETURNS FOR SERIOUS INVESTORS:

Learn more here and watch a short but instructive video here.

LEGAL

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.