Lede

- Disinflation has returned.

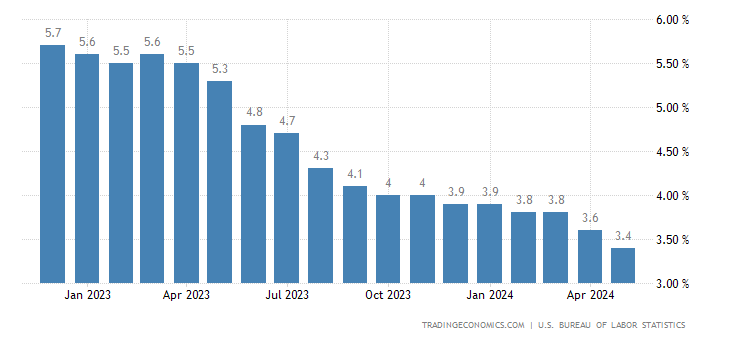

- Core CPI YoY is the lowest it has been since April 2021.

- Core CPI MoM is the lowest since August 2021.

The Fed will deliver a decision today, we will receive a new dot plot (Fed projections for inflation, GDP, and the labor market) and Chairman Powell will hold a press conference.

All of that will be market moving as well.

Our opinion: It’s time to cut rates, and waiting until September takes an unnecessary risk that we will turn to recession given that the unemployment rate has risen to 4.0% from 3.4%. Further, 43% of small businesses in the US were unable to fully pay their rent in April, the highest share since March 2021.

Story

Today we received the CPI report and later today we will receive the fed’s interest rate decision which will be to keep rate unchanged.

CPI and Core CPI for the month over month (MoM) measure and the year over year (YoY) measures all came in below estimates.

- US Inflation Rate (CPI YoY):

- 3.3% vs 3.4% consensus and 3.4% prior.

- US Inflation Rate (CPI MoM):

- 0% vs 0.1% consensus and 0.3% prior.

- US Core Inflation Rate (Core CPI YoY):

- 3.4% vs 3.5% consensus and 3.6% prior.

- US Core Inflation Rate (Core CPI MoM):

- 0.16% vs 0.28% consensus and 0.3% prior.

- Lowest since August 2021

Here is a chart of Core CPI YoY (Source); it’s the lowest in more than three-years:

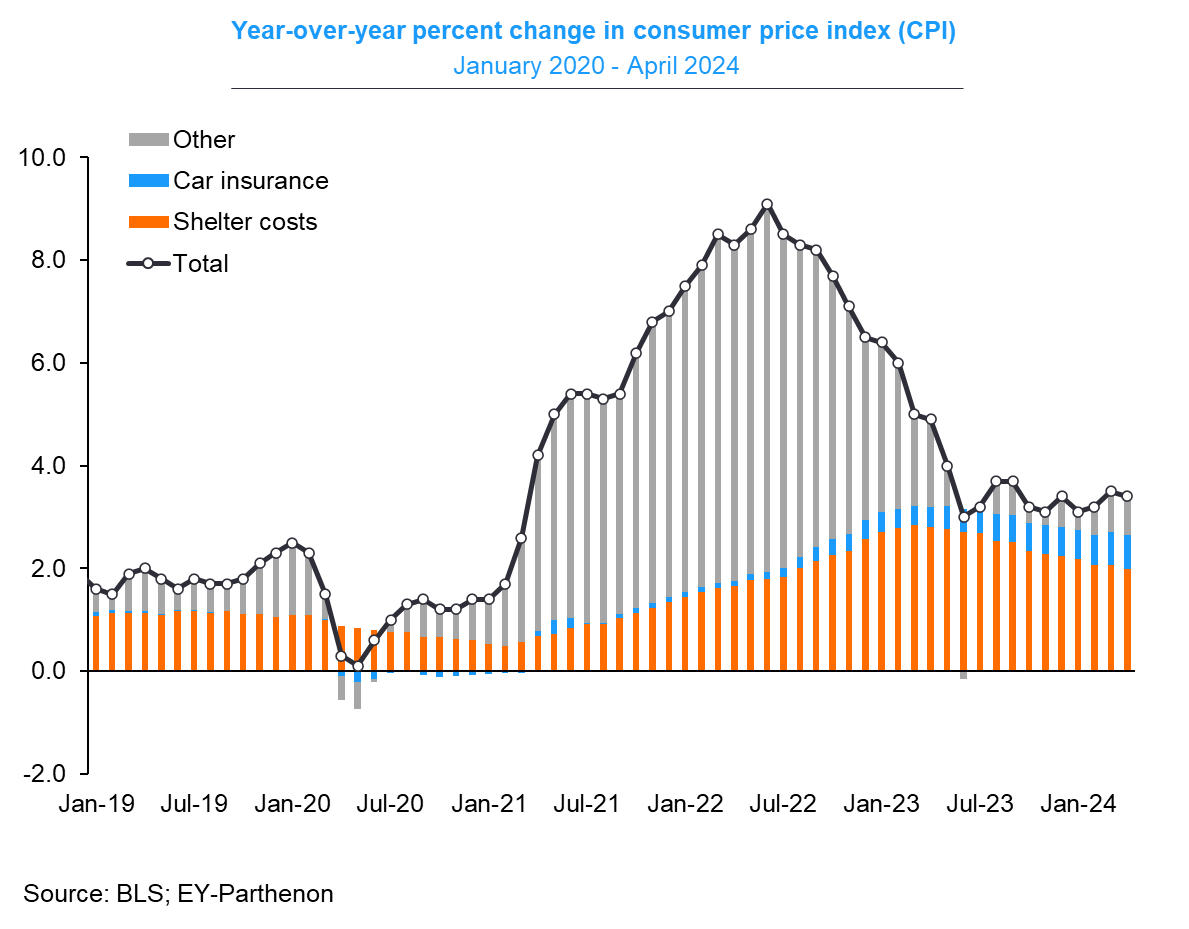

As we have said ad nauseum, there is no inflation in the United State above the Fed’s 2% target, it’s simply the lagged measure of rent (cost of shelter), specifically owner’s equivalent rent (OER), that has the entire world economy on its knees.

Owner’s equivalent rent is the hypothetical rent a homeowner would pay if they rented their own home.

Both rent of primary residence and OER MoM inflation were almost exactly the same in May as in April. There is however, finally, a trend over the last three-months:

These shelter costs make up 42% of Core CPI.

Here is a chart from Gregory Daco of inflation with shelter called out in the orange. Again, there is no inflation issue YoY, it’s all shelter (this is from before this latest CPI report):

And what about shelter makes it so that we can discard the data as not representative?

We have real-time rent data that is factual, as opposed to owner’s equivalent rent which is the hypothetical rent a homeowner would pay if they rented their own home.

Here is a chart: the yellow line is the lagged CPI measure; the red line is from Zillow and the black line is the BLS’ own real-time measure, newly introduced, because exactly of this lagged problem:

Inflation is over.

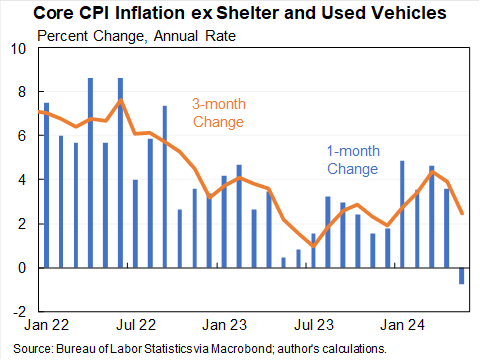

Here is a chart from Jason Furman of Core CPI ex-shelter and used vehicles: it’s negative for the month and at 2.0% for the last three-months.

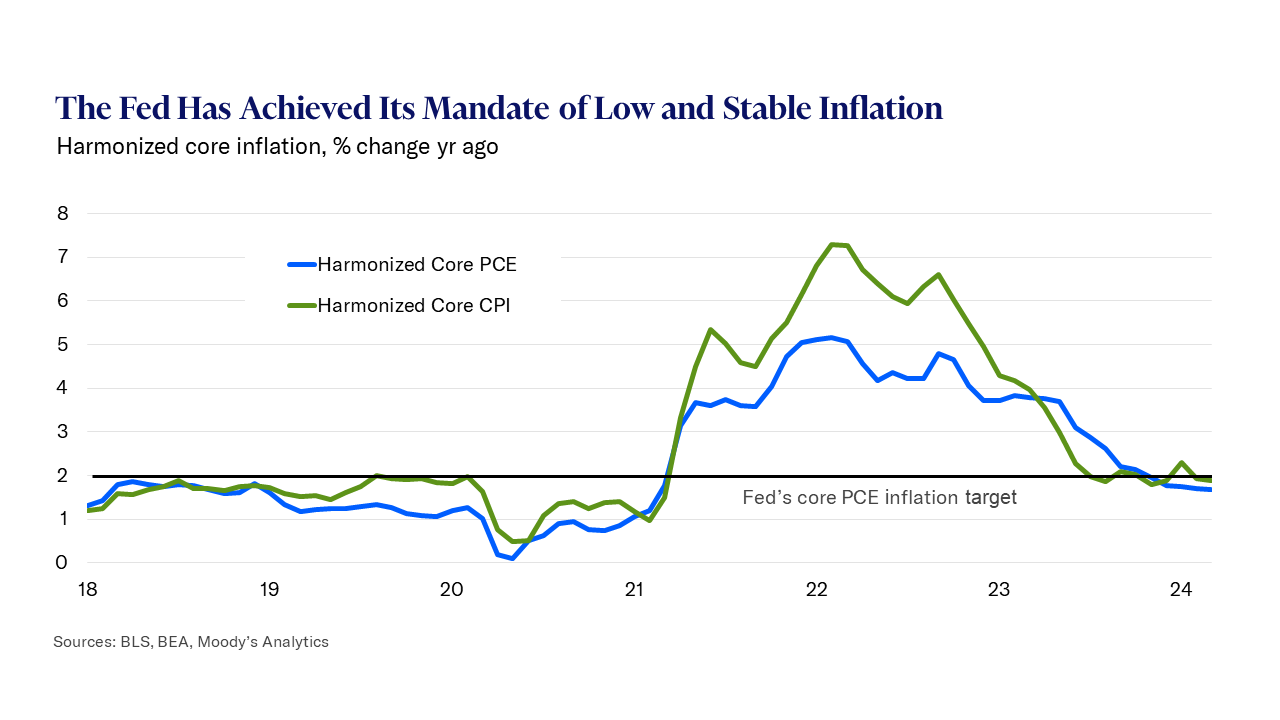

A final chart looks at harmonized core CPI inflation (from the BLS) before this cooler than expected CPI report:

Harmonized CPI (HICP) measures consumer price inflation using market prices and a standardized method across EU countries, while regular CPI measures inflation within a specific country and does not necessarily use market prices.

- Further, core goods costs saw 1.75% decline YoY (as in -1.75%).

Rates have dropped on the news, as they should:

And the probability of a rate cut in the July FOMC meeting has risen to 14.5% and to nearly 73% in September.

We believe that if the various flavors of inflation coming out before the July 31 FOMC meeting (PCE, PPI and the next CPI) are cool and the unemployment rate continues its rise (from 3.4% to 4.0%), the Fed could cut in July… the Fed should cut in July.

Conclusion

The Fed will deliver a decision today, we will receive a new dot plot (Fed projections for inflation, GDP, and the labor market) and Chairman Powell will hold a press conference.

All of that will be market moving as well.

What the Fed thinks about inflation and the underlying economic data is the only thing that matters. The economy appears to be healthy but there are signs of consumer weakening.

Our opinion: It’s time to cut rates, and waiting until September takes an unnecessary risk that we will turn to recession given that the unemployment rate has risen to 4.0% from 3.4%. Further, 43% of small businesses in the US were unable to fully pay their rent in April, the highest share since March 2021.

Thanks for reading, friends.

For a fuller discussion and to look into long-term stock research please learn more about CML Pro:

CML PRO IS PROUDLY UTILIZED BY 500+ OF THE WORLD’S LARGEST FINANCIAL INSTITUTIONS:

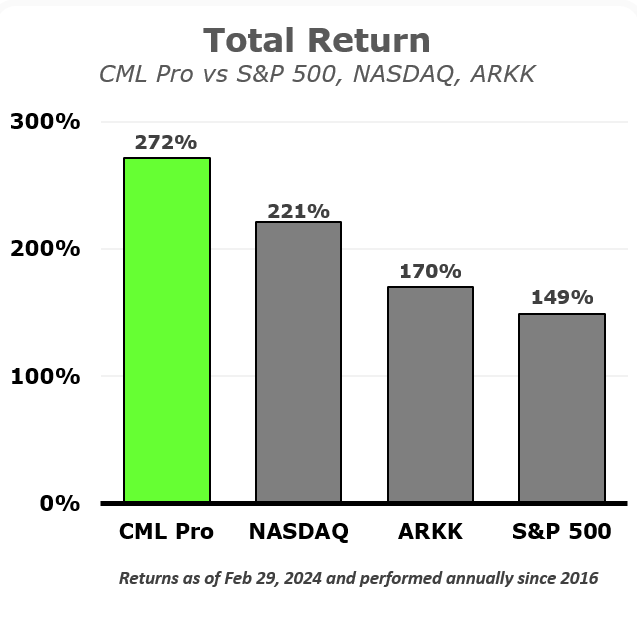

AND HAS DELIVERED SERIOUS RETURNS FOR SERIOUS INVESTORS:

Learn more here and watch a short but instructive video here.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.