Introduction

Understanding Delta is crucial for anyone involved in the trading of options. It helps traders predict how an option’s price will move relative to changes in the underlying asset’s price. This introduction to Delta will explore the importance of Delta in options trading, how it affects the price movement of options, and its role in determining the probability of an option expiring in the money (ITM). Whether you’re a novice or an experienced trader, grasping the nuances of Delta can provide you with a deeper insight into option trading strategies and risk management.

What Is Delta?

Delta indicates how much an option’s price could change with a $1 shift in the underlying asset’s price. A Delta of 0.40 implies a $0.40 move in the option’s price for each $1 change in the asset. The higher the Delta, the larger the price movement.

Traders use Delta to gauge an option’s likelihood of expiring in the money (ITM), with a 0.40 Delta suggesting a 40% chance of being ITM at expiration. However, a high Delta does not guarantee profit, especially if the option was expensive.

Delta can also be viewed as equivalent to owning a certain number of the underlying asset’s shares; for instance, a 0.40 Delta acts like owning 40 shares, moving similarly in value with a $1 price change in the asset.

In English

-

- A 90-delta option will move about $0.90 for the next $1 move in stock price.

- A 50-delta option will move about $0.50 for the next $1 move in stock price.

- A 10-delta option will move about $0.10 for the next $1 move in stock price.

Broadly speaking, ‘Delta‘ measures how far an option is in (or out) of the money and therefore how much it will move for every $1 move in stock price.

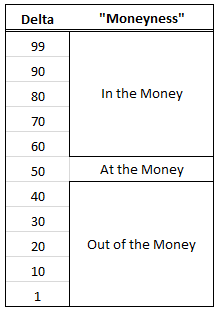

Delta ranges from 0 to 100. The larger the absolute value of Delta, the further in the money an option is. In English:

If an option has a Delta near 100, it is deep in the money.

If an option has a Delta that is near 0, it is far out of the money.

If an option has a Delta near 50, it is near the money (at the money).

Delta as a Probability

In the video below, CEO Ophir Gottlieb, discusses Delta as a probability:

Delta is roughly a measure of probability and that’s what makes option trading so magnificent.

For example, a ’30 delta‘ put should be a winner 30% of the time, or if we sold a 30 delta put, we would expect that we could have a winner 70% of the time. Now, if we can identify a trade that is priced with a 70% win-rate (for example), but find that it wins more often than that, with positive returns, then we have edge — a win that keeps winning.

Conclusion

Delta is more than just a measure of price sensitivity; it is a fundamental tool for an options trader. By understanding Delta, traders can make more informed decisions, assessing the potential risks and rewards of their trades. It not only helps in predicting price movements but also in evaluating the probability of success. As Ophir Gottlieb, CEO, discusses, viewing Delta as a probability can uncover trading strategies with a potential edge — turning what seems like ordinary trades into opportunities for consistent wins. Whether you’re assessing the likelihood of an option expiring in the money or determining how similar an option is to owning the underlying asset’s shares, Delta is a concept that illuminates the intricate dynamics of option trading.

Legal

The information contained here is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained here. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

Trading in options involves considerable risk and is not a suitable form of investment for all investors. The risk in options trading that you will lose your entire investment within a relatively short period of time is comparatively high.

Past performance is no guarantee of future results.

Traders should read Characteristics and Risks of Standardized Options.