4-5-2024

Lede

The number of jobs added in March blew the doors off of consensus estimates, while the unemployment rate dropped, labor force participation came in well above estimates, and wage inflation is now at multi-year lows.

Today was a good day, but…

One note of caution, the non farm payrolls report and all of the data inside of it tends to get revised and the revisions can be substantial. So this is a “good day,” for now. Again, there are some very competent economists who assign this report and some of its data nearly no value until two months after the report when final revisions are settled.

First, the data, then the commentary:

Data

- US Non Farm Payrolls:

- 303K vs 200K consensus and 270K prior.

- US Average Hourly Earnings YoY:

- 4.1% vs 4.1% consensus and 4.3% prior.

- US Average Hourly Earnings MoM:

- 0.3% vs 0.3% consensus and 0.2% prior.

- US Average Weekly Hours:

- 34.4 vs 34.3 consensus and 34.3 prior.

- US Unemployment Rate:

- 3.8% vs 3.9% consensus and 3.9% prior.

- US Labor Force Participation Rate:

- 62.7% and 62.5% prior.

Takeaway

As wage growth dips to 4.1% from 4.3%, yet job growth shows a solid increase, hitting averages of 303K-276K over three months and 244K over six months, it is well within reason for the Fed to ease up on the tight policy rate, especially if we continue to see progress in PCE inflation (it’s target).

The Fed’s job is not to slow the economy, it is to slow inflation while keeping the economy growing. That’s where we are.

Story

We got a significant positive surprise in the job report with minimal inflationary impact.

The cause: the bulk of employment growth was in lower to middle-income positions, which is promising, especially since this segment of the economy has faced the greatest challenges, with dwindling savings and escalating costs.

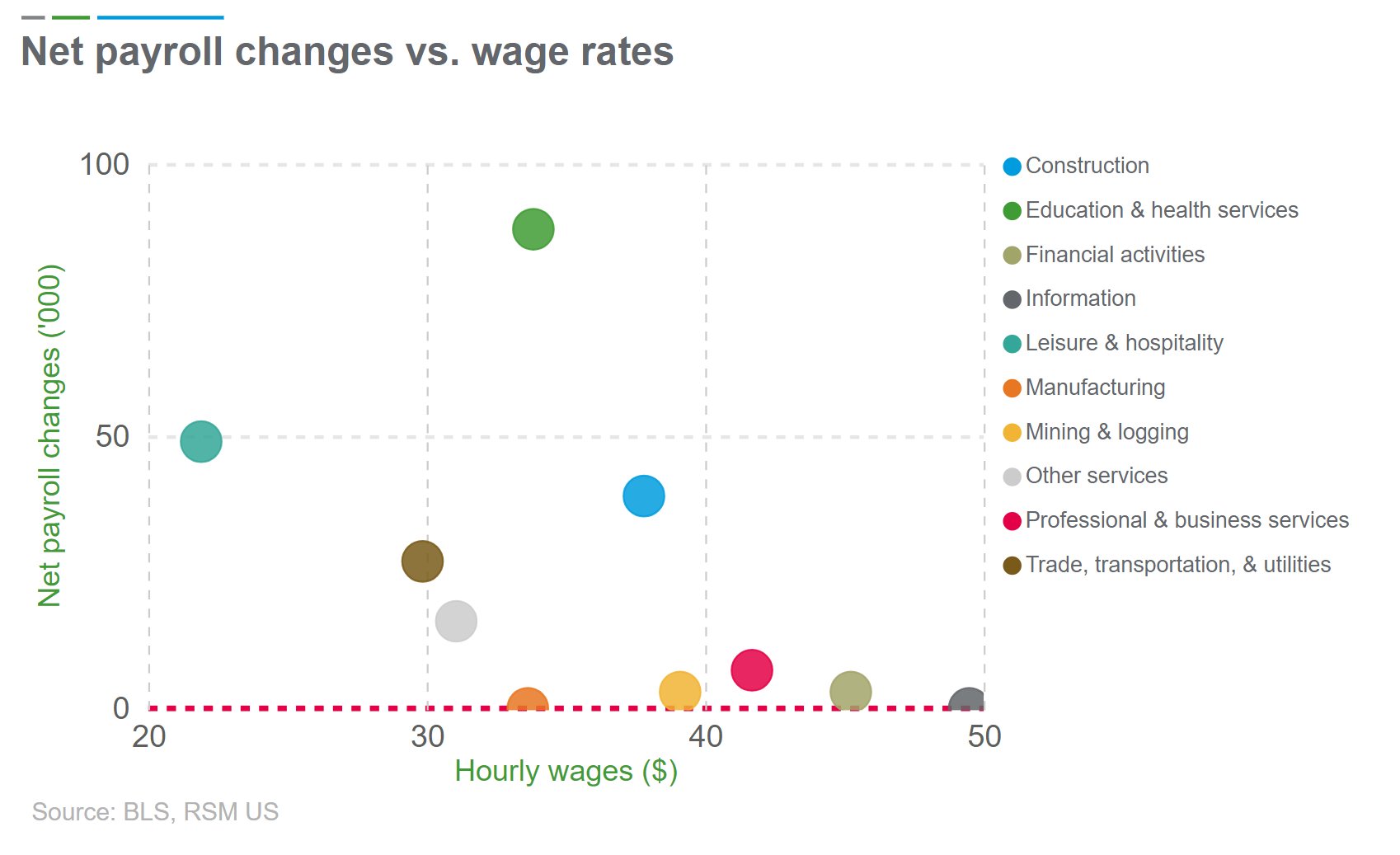

Here is a cool graphic from Tuan Nguyen, Bloomberg’s forecaster of the year in 2023. Note that the points highest (vertically) on the chart represent the sectors with the largest job growth, and they tend toward the left off the chart – the portion with lower wages.

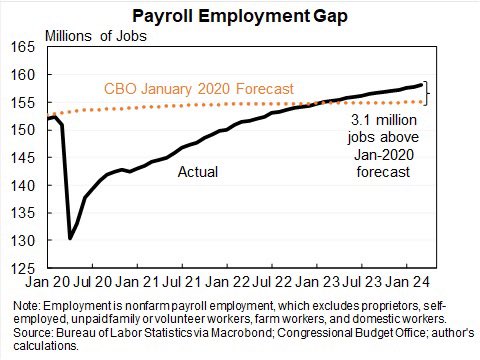

The US economy remains well above CBO’s (Congressional Budget Office) pre-pandemic forecasts:

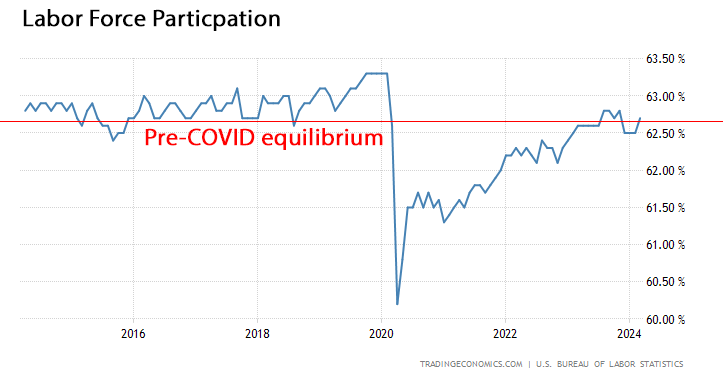

The labor force participation rate increased from 62.5% to 62.7%, reflecting the positive impact of domestic supply-side factors that have driven the current period of exceptional economic performance in the US and reinforcing US economic exceptionalism from many other developed nations:

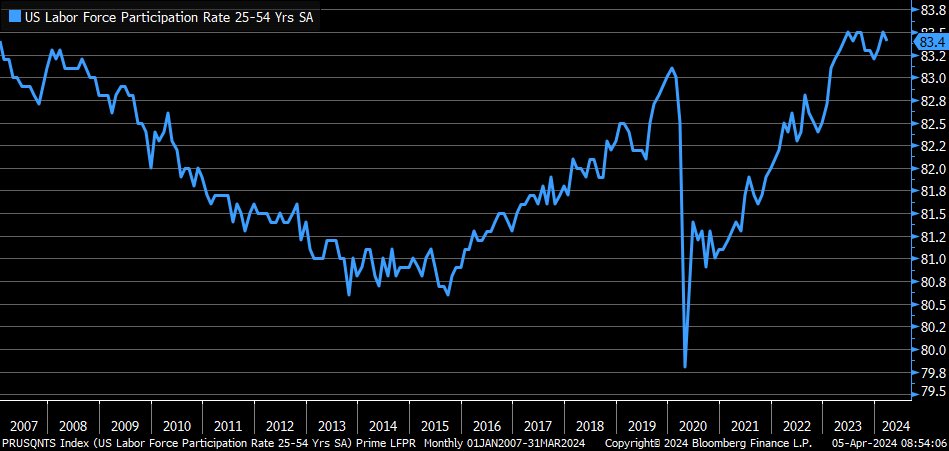

Prime age labor force participation, those people aged between 25-54 dropped a little, but remains at multi-decade highs:

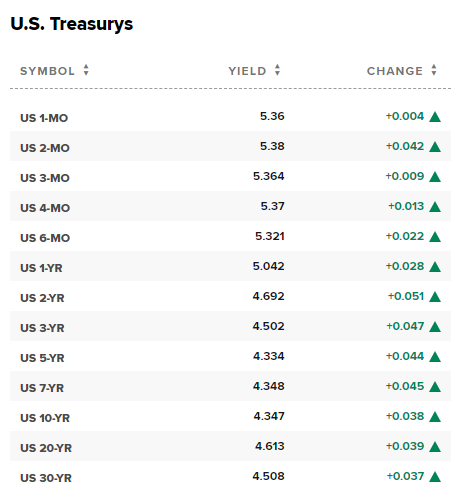

As for market reactions, we have the following:

Treasury yields are a bit higher.

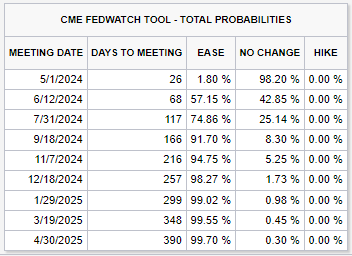

The probability of a rate cut has dropped in June to 57% and those probabilities are getting pushed out to September:

The stock market, at the time of this writing, is slightly higher across the board, with the S&P 500 up about 0.5% and the NASDAQ 100 up about 0.8%.

Conclusion

The Fed doesn’t need weak economic data to cut rates – the Fed needs inflation to drop to cut rates.

Slower wage inflation is one of many factors. The crucial factor is PCE and Core PCE inflation which we wrote about a few weeks ago.

Those numbers look good, with PCE inflation at 2.5% and Core PCE inflation don to 2.8%.

The Fed’s summary of economic projections (SEP) indicated that if Core PCE were to be 2.6% by year end, that would support two to three rate cuts in 2024.

Well, we’re about to find out.

What the Fed thinks about inflation is the only thing that matters… as long as the economy stays strong.

The economy is strong. That’s a win.

Rates are just conversation if the economy stays strong and inflation stays tame. After this may be here, but then again…

… What the Fed thinks about inflation is the only thing that matters… as long as the economy stays strong.

Have a fabulous weekend.

Legal

The information contained here is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained here. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

Trading in options involves considerable risk and is not a suitable form of investment for all investors. The risk in options trading that you will lose your entire investment within a relatively short period of time is comparatively high.

Past performance is no guarantee of future results.

Traders should read Characteristics and Risks of Standardized Options.