Lede

As we enter earnings season, many different types of set-ups will trigger and we will share some here.

Preface

In general, we focus on three types of markets: up market, recovering market, down market.

Today we share some live triggers for two of those type: up market and recovering market.

Up Market Triggers

In this regard we look at a pre-earnings trade that speculates on stock price optimism the 14-days before a verified earnings date.

The image of the trend is included below:

But, in order to benefit from the “vega (or theta) paradigm,” we look at diagonal call spreads.

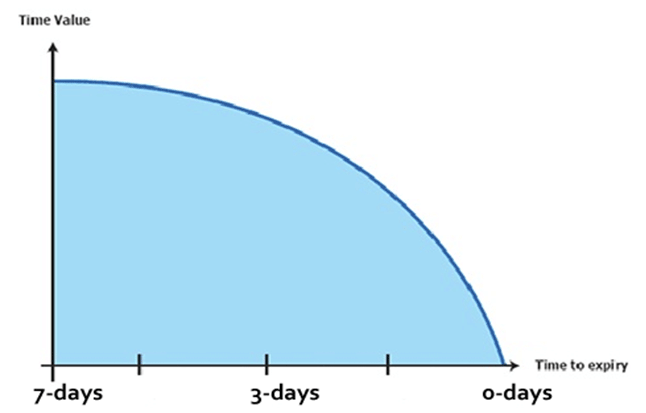

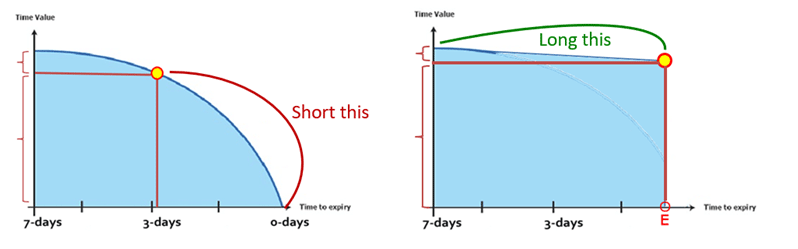

The vega (or theta) paradigm is a phenomenon that options normally see time decay in a curve that experiences exponential decay, like this:

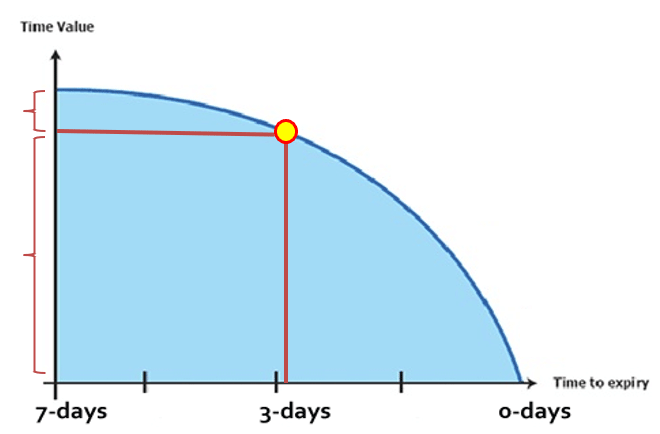

It may not be immediately apparent that the time value of the option decays exponentially, so we mark up that same chart below:

On the left hand side, we have bracketed the amount of time decay a normal seven day option experiences in the first half of its life (3.5 days), versus the amount of decay the option experiences in the second 3.5 days of its life.

The vastly larger decay in the second half of the option’s life is the first part of vega (or theta) paradigm.

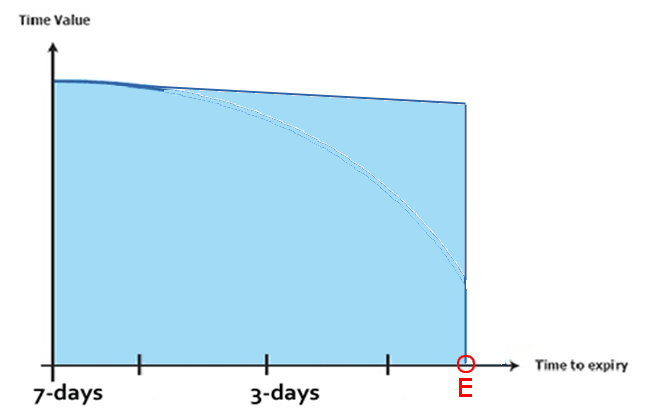

But, the second portion of the paradigm comes from understanding how an option which has an earnings event inside of it behaves differently.

Here is an image of that decay:

The decay is quite small right until the earnings event occurs, and then it falls of a cliff, similar to a straight vertical line.

So, while we want to construct a strategy that benefits from pre-earnings stock optimism (an up trend), we want to double that with the vega (or theta) paradigm.

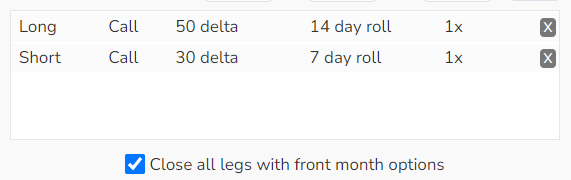

We do so by testing a strategy that gets long a call option that expires after earnings, and gets short a call option that expires before earnings.

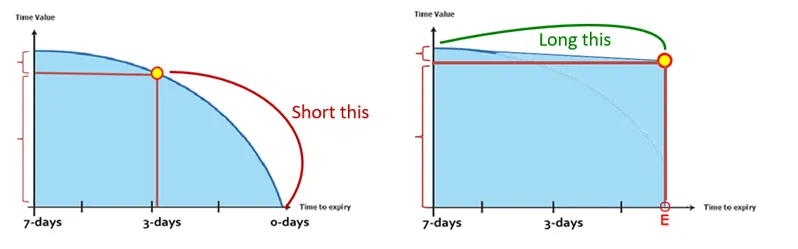

Put into an image that encapsulates what we discussed above, we see this:

So, long the option that decays very little (and closing it before earnings), and short the option that decays exponentially.

We offset the strikes (the deltas), to create a bullish stance.

In this case, long the at-the-money call (50-delta) that expires after earnings and short an out-of-the-money call (30-delta) that expires before earnings.

The entire trade closes when the short dated options expire:

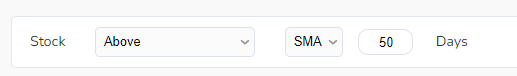

We add a technical opening rule that only opens this backtest if and only if the stock price is above the 50-day simple moving average:

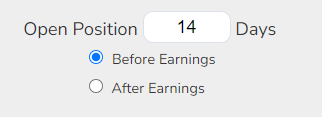

The timing is to look 14-calendar days before-earnings:

OK, that’s the set-up (the plan).

We see three long-term winners of this strategy triggering today:

PLTR, TEAM, and AAPL.

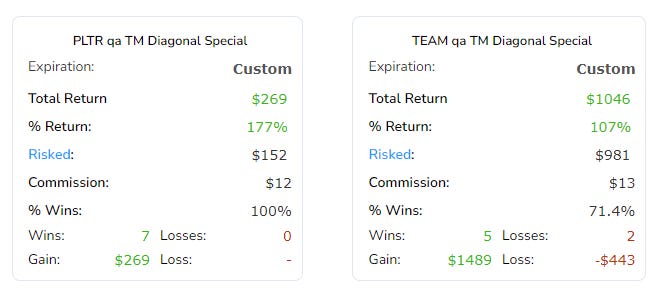

Here are the backtested results for the first two stocks over the last 3-years:

Backtest Link

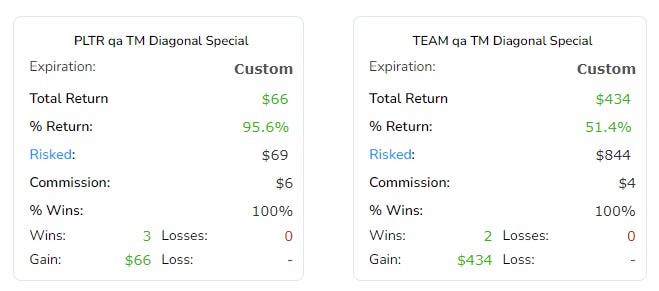

And here are the results over the last year:

These two stocks today are 14-days before verified earnings and are both above the 50-day simple moving average and that means… the backtest triggers today.

We have shown how this works in the magnificent seven and the mega banks in earlier posts.

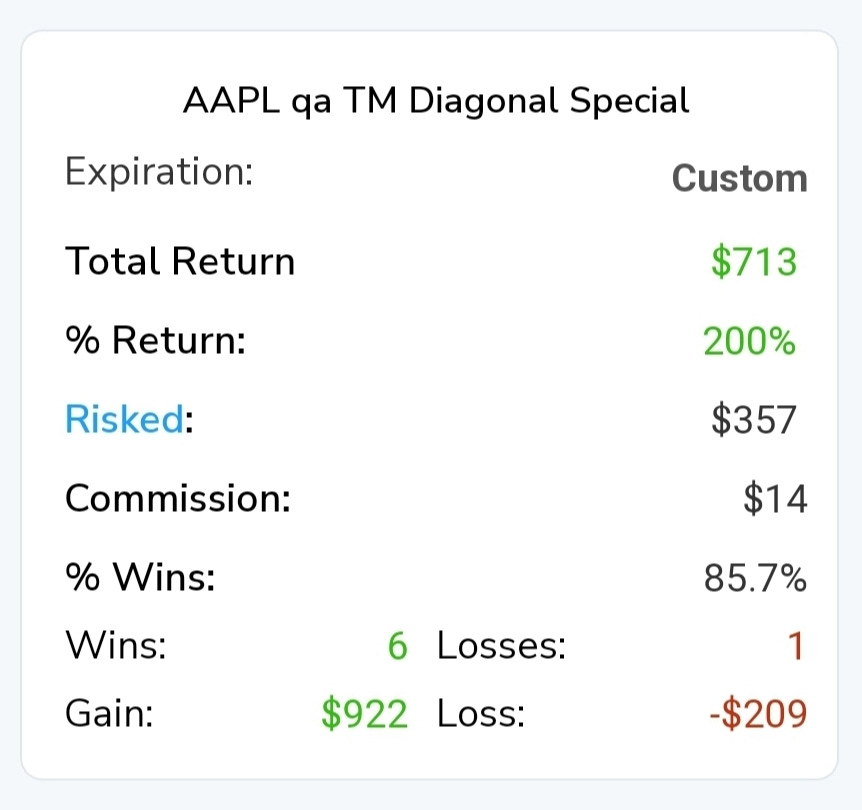

Here is AAPL:

TradeMachine members, we have 23 of these trades ready for this quarter, and you can access them here:

Recovering Market Triggers

We also see a trigger for a recovering market today in NFLX.

We share that set-up with TradeMachine members only.

We have 43 of these alerts set as well (also only for TradeMachine members).

Some of the tickers in this group are the following:

- NFLX

- AMD

- ASML

- COST

- DDOG

- META

- MSFT

- NVDA

- ZS

Alright, that’s it for now. Good luck traders and please do read the disclaimers at the end of this post.

Conclusion

Leveraging the recurrent trends has consistently yielded robust outcomes.

Adding a filter for our proprietary kurtosis measure increases win rates and average returns over both one- and five-year periods.

These results on this strategy span far more than the mega caps, and we discuss and share that research in TradeMachine, going back over a decade.

To learn more about TradeMachine®, our backtesting software, you go here:

TradeMachine – The Who, What, Why, and How

TradeMachine allows for large scale customization on the one-hand, along with easy to use and nearly immediate results on the other.

Legal

The information contained here is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained here. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.