Lede

Last time we wrote How to Trade the Magnificent Seven: “Not That Bearish” is Profitable, in an effort to construct an historically profitable strategy when the stocks had fallen into correction (down 10% or more) in the last 30-days where the speculation benefitted simply by either the stocks not going down very much, or going up.

Today we get more constructive, and look for a bullish strategy with different rules but also looking for an oversold situation.

The Set-up and Results

I’ve heard arguments for and against technical analysis but one of the few triggers that has back tested exceptionally well across 10-, 5-, 3-, 2-, and 1-year has simply been when RSI dips below 25 in large cap stocks.

Once that oversold level is achieved, the next 30-days tend to be quite constructive for the stock.

In fact, before we turn to options, we can use TradeMachine® to do a one month backtest in the (current) magnificent seven stocks when the RSI dips below 25.

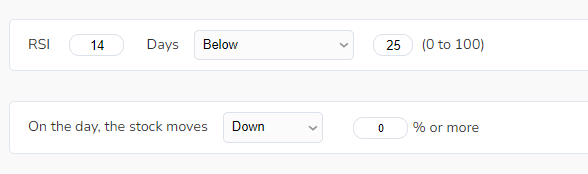

Here is the open trigger:

It waits for RSI to dip below 25 and for the stock to be down on the day (any amount).

The closing rule would be one-month (22-trading days), or when RSI creeps back above 40, whichever happens first.

We call this strategy “Buy the Sell-off” in our scanner and the results are available across all companies in TradeMachine®.

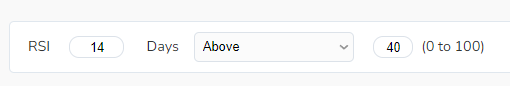

And here are the stock returns for those companies over the last decade.

It has only happened 31 times in the last ten-years in total for these companies, but yeah, the next month was higher 28/31 times and on average the stocks rose 5.5%.

Alright, well, let’s turn that reality into an option strategy.

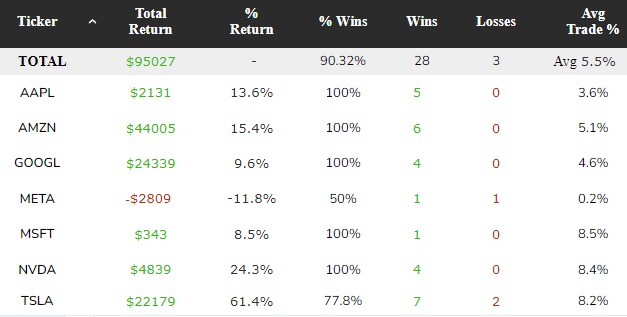

In this case, we will test getting long an at-the-money call (50 delta) with 60-days to expiration and getting short an out-of-the-money (20 delta) call with 30-days to expiration; a calendar call spread.

The trade closes when either (i) the RSI rises back above 40 or (ii) the short-dated option expires, whichever happens first.

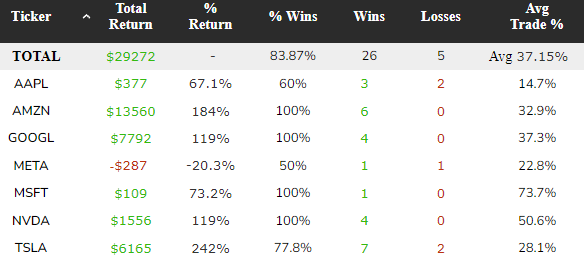

And here are the results over the last decade:

We see 26 wins against 5 losses (84% win rate), and that 5.5% average stock return has been leveraged into a 37.15% average option trade return.

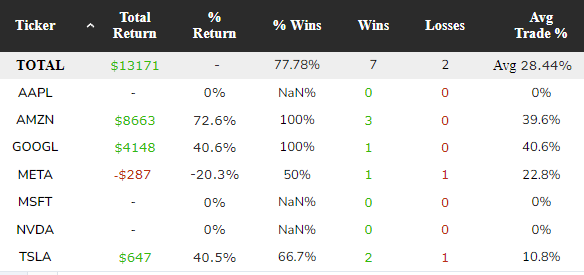

We can look at the last 3-years as well:

Over 3-years, we see a 78% win-rate and an average return of 28%.

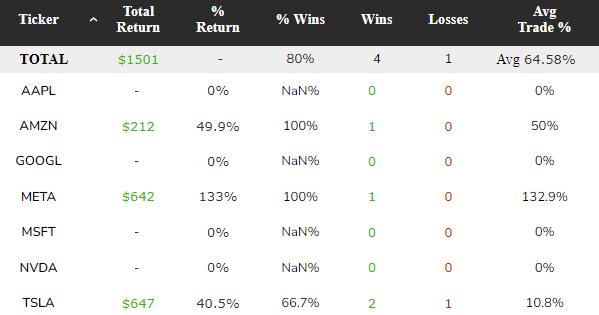

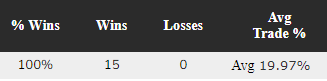

Finally, we look at the last year:

Over the last year, the deeply oversold condition happened just four times, all four were a winner with the diagonal call spread, and the average trade returned 65%.

Taking it All Together

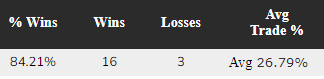

We can reprise the totality of our strategies for the magnificent 7 (over the last 3-years).

- Pre-earnings Diagonal Call Spread (magnificent 7 + 4 mega banks)A speculation designed to benefit from pre-earnings optimism while avoiding earnings risk and leaning on 1-year kurtosis greater than 1:

- “Not That Bearish”1x2x1x2 Ratio Spread

- Buy the Sell-off

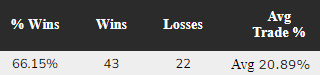

In total, we’re looking at 99 trades in 3-years, so about 33 trades a year, or 3 trades a month.

The total win rate is 74 wins and 25 losses or 75%, and the average weighted trade was 22%.

That’s a nice portfolio of trades, some of which sell vol, and some buy vol. Some surround earnings, some use short-term options, and some use medium-term dated options.

And if this is what we can find in just these seven (or eleven) companies, then imagine the portfolio of alerts and trades TradeMachine® members can compose for their days. months, years, and career.

Or don’t imagine, and just do it.

Conclusion

There’s a difference between wanting something and liking the idea of something.

The difference is that one is for day dreams and the other is effort.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.