Lede

Make lemonade out of lemons: the volatile period from Sep – Nov provides opportunity.

Preface

Yesterday we looked at bullish set-ups going into earnings in the magnificent seven and the four mega banks.

Today we will look at some set-ups that have nothing to do with earnings, but rather that identify when a bounce may be due in a dropping stock or index, and what has succeeded in the past when that occurs.

We must do the following:

- Explicitly define what identifies a “dropping stock (or index).”

- Explicitly define the option strategy to test when it occurs.

Backtests

We start with TSLA.

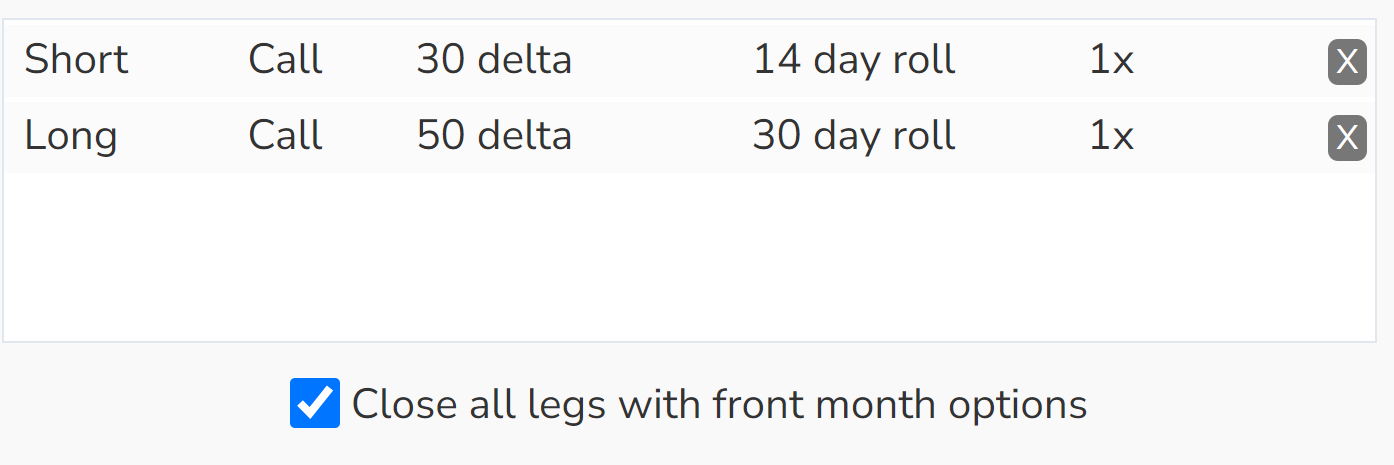

We tested the results of getting long a 30 day / 14 day calendar call spread using a long 50 delta (at the money) call and short a 30 delta (out of the money) call.

Here is the strategy for clarity:

The strategy closes when the short-dated option expires (thus the check box at the bottom of the image that reads “close all legs with front month options.”)

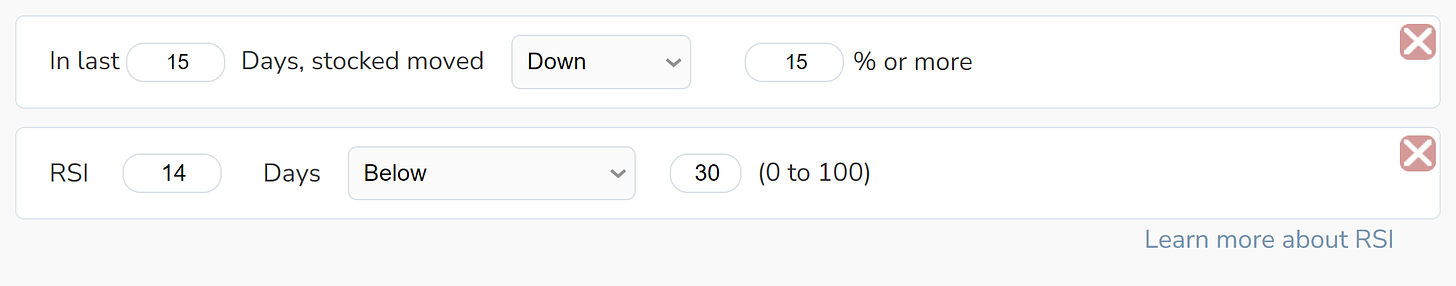

The technical condition we tested was when TSLA stock was down 15% or more in a 15-day period and the RSI is below 30.

Here is the set-up in TradeMachine:

And finally, the results over the last 3-years of this long calendar call spread that looks to “buy the bounce.”

That’s six wins and two losses and a total return of 174% over those eight trades.

Let’s look at the same set-up, but an alternative approach. Rather than buying a call spread, we looked at selling a put spread.

We tested selling a 14-day 30/10 delta put spread.

As we would expect, the win rate went up and the total return went down.

This is a matter of preference for the trader.

We will examine many more of these set-ups in the coming weeks as the Sep – Nov timeframe tends to have a lot of “uh, oh” periods.

Since we’re here, we will share a backtest for the SPX index.

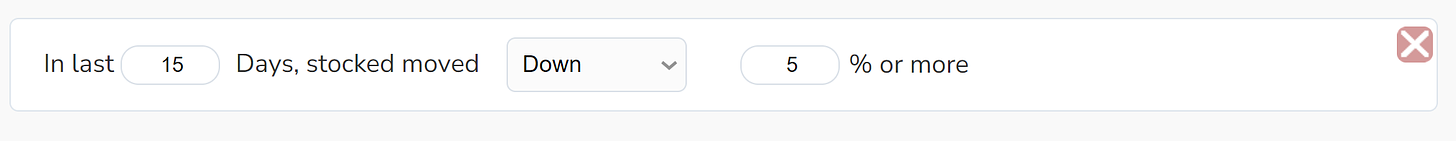

In this case we simply tested getting short a put spread when the SPX realizes a 15-day period where it has dropped 5% or more:

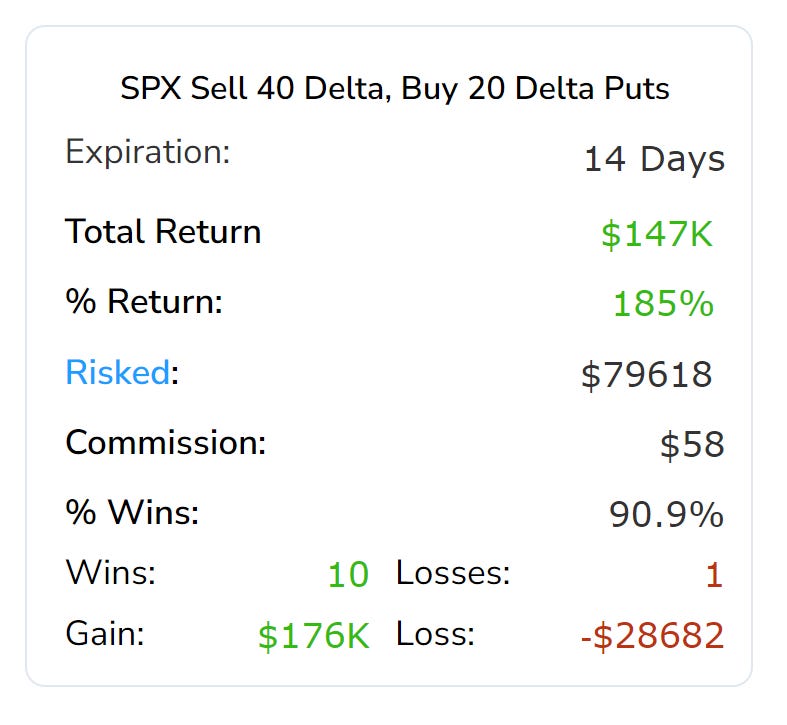

And here are the results:

Backtest Link

This type of drop has happened 11 times in the last three-years, and 10 of those times selling a two-week 40/20 delta put spread was a winner.

This is not even the tip of the iceberg of where we will go and where TradeMachine members can go with the simplest idea: making lemonade out of lemons – or in trader speak, making money when the market (or a stock) is tumbling lower.

Conclusion

If you’re an option trader, I’d say “turn on the headlights” before entering a trade, and that’s what TradeMachine does for you.

Go this page to learn more about TradeMachine and watch a short video.

If options are not your cup of tea, then stocks likely are, and you can learn more about Pattern Finder here: Learn About Pattern Finder

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.