Lede

Today we look at post-earnings patterns and a volatility burst pattern.

Stocks, Backtests, and Charts

Today we look at two tech stocks that went down after earnings, but have a tendency to recover post-earnings specifically after a drop.

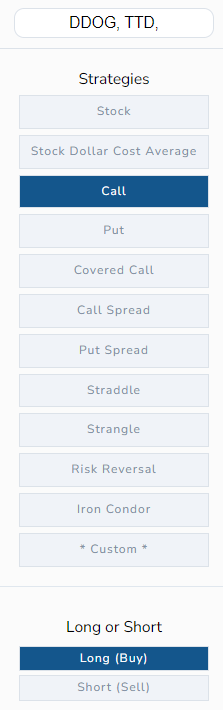

We look at tickers DDOG and TTD.

Both companies reported earnings earlier this week, and both dropped off of the reports, though numbers were pretty strong.

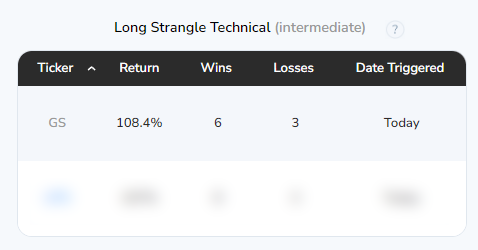

The backtest looks like this:

- We want to test getting long an out of the money 30-day call.

- We want to do so only after earnings and only after an earnings drop.

We can ask TradeMachine to do that in about three seconds with these settings:

The backtests look to open that long call five-days after earnings and close it no later than 30-days after earnings.

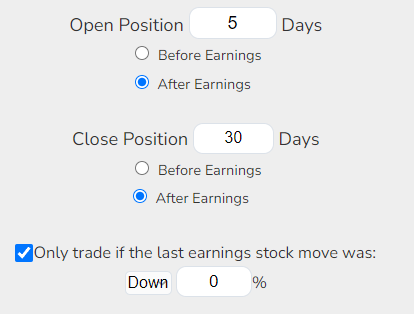

- We set a technical condition for the stocks to be below the 50-day moving average

This too take a second or two in TradeMachine:

We note that DDOG is below the 50-day SMA but TTD is not, so DDOG would be active in a few days and TTD would be (or could be) one to set an alert for future earnings cycles.

- Finally, as proper trading plans should have, we set a stop and a limit, in this case a 40% stop and 40% limit.

This takes a second or two in TradeMachine as well:

Alright, and here are the results over the last 5-years of precisely that backtest:

Backtest link

There you go: in about 10 seconds we backtested a post earnings momentum pattern in two stocks if and only if the stocks are down off of earnings.

We just as easily could have left no requirement for a post earnings down move, or even used a requirement for an up move off of earnings. It’s all 1-2 seconds away.

Next we turned away from directional trading and away from tech.

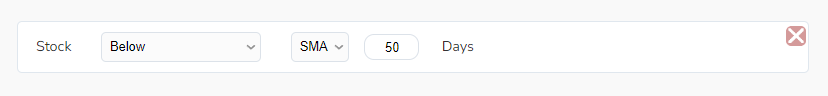

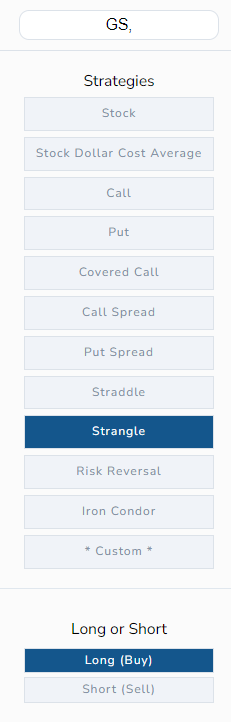

We took a peek at the Today Tab in TradeMachine and focused on a non-directional backtest:

The “long strangle technical” is our jargon for getting long a short-term out of the money call and put (at the same time) for a quick exposure to risk looking for a volatility burst (a big stock move).

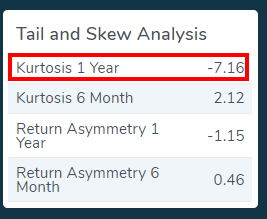

We noticed that the one-year kurtosis in GS is quite negative, which should be ideal for a sock ready to move a lot – possibly downward. Here is a snapshot from Pattern Finder:

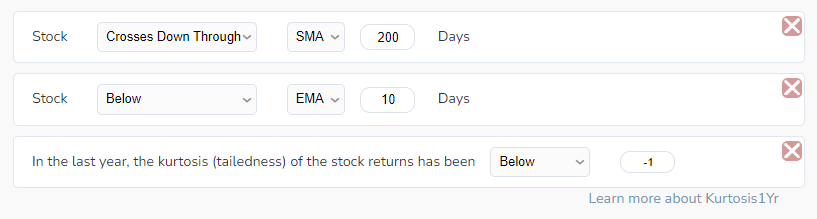

Next we let TradeMachine run its backtest from the Today Tab by clicking on the ticker, and this is the set-up, specifically:

And it has its own technical requirements for the trigger and we added the last one (one-year kurtosis less than -1).

The trigger is simple: the day the stock crosses below the 200-day moving average (technical failure) and when it is already below the 10-day EMA.

And, here are the results over the last five-years:

Backtest link

There you go: three trade ideas in about one-minute of work, where TradeMachine did hundreds of millions of computations and all we we did was click a few buttons.

If only identifying trade ideas was this easy… oh, wait, it is…

Conclusion

The data and rationale behind the remarkable finding we have discovered surrounding our proprietary skew and kurtosis can be found in TradeMachine and the link below:

Go this page and scroll to the middle of the page for the video.

It looks like this:

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.