Preface

Today we will look at a stock in various ways, but more than anything else, set a trading plan for potential pre-earnings momentum.

We are big believers in planning your trades and writing it down.

We note, before any of the analysis below, that Thursday (in two days) is the CPI report and the entire market could move in one direction or the other and solid chart work and backtesting could prove to not help much if the number is a shocker (good or bad).

This is a known systematic factor approaching so… know it…

The Execution of a Plan

We will start inside Pattern Finder with screen I created myself and anyone is welcome to copy it (replicate it by copying the filters) for themselves.

Here are the filters:

The screen looks for a recent up trend, certain market cap and revenue minima, and then of course the return distribution dynamics that we shared in our remarkable findings webinar.

We plucked out ticker DDOG.

Here is the 3-year chart for DDOG and we ask Pattern Finder to turn on the following algorithms for us, so it can mark up the chart instantly:

- Trend resistance (green line)

- Trend support (red line)

- Congestion points (pink lines)

- CANSLIM shapes

- Distance to nearest upside resistance (green fill) and downside support (red fill)

Everything in this chart is available to Pattern Finder Standard members for just $28/mo. The skew and kurtosis data, which we discuss soon, is only available to Pattern Finder Pro members ($84/mo).

We can see DDOG has had a monstrous recent run off that trend support that Pattern Finder drew in and an 80% rise.

We zoom in for more clarity on the recent run and the next upside and downside target zones.

DDOG has something else going for it in this plan, and that is an earnings date that has already been announced (8-3-2023).

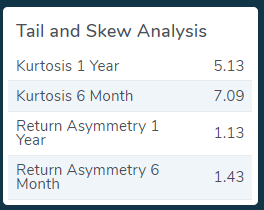

Now we turn to the exceptional data, and that means return distribution characteristics:

We see that the 1- and 6-month net skew and 1- and 6-month net kurtosis are all positive. If this is new terminology to you, we link to an explanatory webinar at the end of this post, but the short explanation is this:

Kurtosis

A statistical measure that essentially measures the “tailedness” of the probability distribution. It specifically provides information about the tails and sharpness of the distribution.

A measure of risk (or opportunity).

Skew

In the context of stock performance, skewness or skew refers to the measure of the asymmetry of the probability distribution.

Our findings (linked in the conclusion) show that when certain skew and kurtosis dynamics are met for a stock, the future one-year returns are double that of the index (S&P 500). Details of this are in the link in the conclusion, that little snippet was hardly complete.

So, now we have a bullish chart and bullish return distribution characteristics.

This gives us some confidence in the stock and then we can turn to options and we turn to TradeMachine.

We’ll examine the “pre-earnings optimism” pattern which looks like this on a chart:

The idea is to find stocks with some momentum into earnings to benefit from that, but this strategy does not hold through earnings.

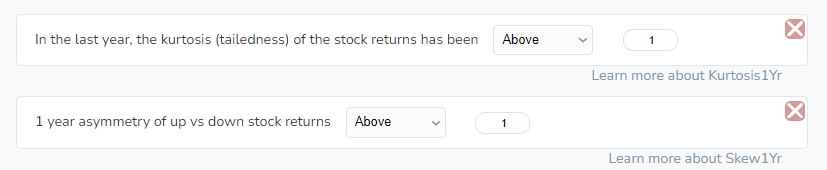

We then tested a calendar call spread opened 14-days before earnings in DDOG over the last 5-years as long as on that day (14-days before earnings), the 1-year net kurtosis is above 1 and the 1-year netskew is greater than 1:

Here are the results for a one-week trade:

Alright, that’s the plan:

- Has a bullish chart

- Has seen recent momentum

- Has bullish return distribution characteristics

- Has a strong backtest (for option traders)

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.